Low inflation remains the key risk to recovery in some advanced economies. Despite subdued price expectations, the International Monetary Fund (IMF) projects that most major advanced economies, including Canada, the United States, the United Kingdom and even Japan will return to their central banks’ targets of two percent inflation by 2019. In the euro zone, however, inflation is only projected to gradually rise to 1.6 percent by 2019. Even more concerning, the IMF estimates that the euro zone currently faces a 20 percent probability of deflation in the coming year. Sustained inflation around the European Central Bank’s target is important for the recovery in the euro zone because of its implications for debt dynamics, uncertainty, the allocation of credit and relative wage adjustments.

The debt dynamics exercise performed in January has been replicated using the updated projections in the April 2014 World Economic Outlook. The IMF currently projects that the debt-to-GDP ratios in Greece, Ireland and Italy will peak in 2014 at 175, 124 and 135 percent, respectively. Public debt was expected to have peaked in Portugal in 2013 at 129 percent of GDP and Spain’s is projected to peak in 2017 at 104 percent of GDP. If euro-zone inflation were to fall to zero percent and remain at that level over the medium term, the debt ratios in Greece, Ireland, Italy and Portugal would make little improvement by 2019, resting at 151, 118, 134 and 125 percent, respectively. In Spain, debt would continue to rise over the medium term, reaching 111 percent of GDP by 2019. For every one percentage point that the domestic inflation outcome falls below the IMF’s projections, the expected debt-to-GDP ratio increases by over one percentage point in Greece, Ireland, Italy and Portugal. In Spain, the debt-to-GDP ratio increases by approximately 0.9 percent because of the current lower stock of debt.

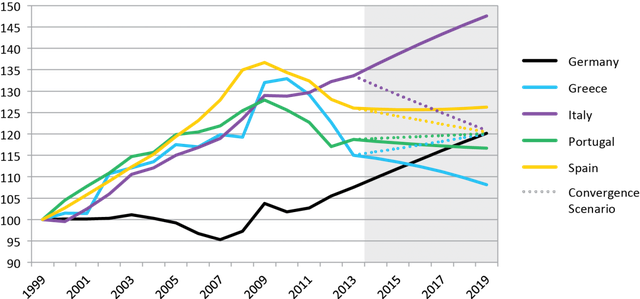

Low inflation also has implications for the adjustment of unit labour costs (ULC) — a widely used measure of competitiveness — within the euro zone. As illustrated in Figure 1, a large gap in real ULC between Germany and the euro-zone periphery emerged from the creation of the euro in 1999 to the start of the Great Recession in 2008. Throughout the crisis, most of the euro-zone periphery countries, with the help of Germany, have been working toward closing this gap (the notable exception is Italy).

ULC has two components: labour productivity and labour compensation. When growth in real labour productivity is higher than growth in real labour compensation, real ULC decrease, and vice versa. This link between labour productivity and compensation is used to analyze trends in real ULC within the euro zone and to consider the implications of low inflation on convergence.

If Greece and Portugal continued along the observed trends in labour productivity and compensation, they would catch up to the German levels of real ULC by 2016 and 2018, respectively (Figure 1). Greece has been decreasing its real ULC by cutting real labour compensation throughout the crisis, while Portugal has ensured that growth in real labour productivity remains higher than growth in real labour compensation. If current trends continue, real ULC in Spain would remain relatively flat, but would still approach that of Germany, due to relatively high growth in labour compensation paired with low growth in labour productivity. Italy stands out among its peers: its low growth in labour productivity and relatively high growth in labour compensation would ensure that the gap between its real ULC and that of Germany remains stagnant over the medium term, while its gap with the rest of the periphery countries would continue to widen.

Based on growth trends in labour productivity and in ULC in Germany, we estimated the rate of growth of labour compensation required in the euro-zone periphery countries to converge with German ULC in five years (dotted lines in Figure 1). With relatively higher growth in labour productivity, Portugal and Spain could maintain an average growth rate of real labour compensation of 1.6 and 1.2 percent over the next five years, respectively. Greece could also maintain a positive growth rate of real labour compensation by an average of 0.3 percent, much lower than that of Portugal and Spain because of contractionary growth in labour productivity in Greece. Italy is the only country in the sample that would need to decrease real labour compensation; it must do so at an average rate of 1.5 percent per year over the next five years to catch up with German ULC. Although such adjustments may be challenging to implement immediately, given the current trends in ULC growth in Italy, delaying any adjustment efforts could escalate the problem, making adjustment even more difficult in the future.

Figure 1: Real ULC Trend Projections and and Convergence Scenario

Low inflation or deflation makes it harder to adjust real wages for two reasons. First, cutting real wages or even keeping them flat in an environment of low inflation could require cuts to nominal wages. Workers may unwittingly accept cuts to real wages, as long as their nominal wages continue to rise, but cuts to nominal wages are usually highly contested. This is already an issue in Italy, where the necessary real wage cuts are higher than inflation projections over the next three years. The second challenge to adjusting real wages is legal barriers from labour contracts. This is particularly challenging for countries with high labour union density — the proportion of workers that belong to a union. In fact, Italy and Greece, the countries that require the lowest growth in labour compensation, have relatively high labour union densities of approximately 36 and 25 percent, respectively, much higher than Germany, Portugal and Spain, which have densities of 18, 19 and 16 percent, respectively.[1]

Convergence in ULC is desirable as it ensures that prices of goods and services are more closely aligned within the euro zone. This, in turn, contributes to correcting internal imbalances. At the same time, decreasing ULC by focusing on wage adjustment can be practically infeasible and create social unrest. At the same time, a more competitive position within the euro zone is not necessarily sufficient for stimulating demand, especially if it comes at the cost of higher unemployment. Rather, policy makers should focus on improving productivity by implementing effective growth-enhancing structural reforms.

Despite the complexity of the task at hand, these exercises highlight that low inflation or deflation has adverse effects on recovery through, for example, its impact on debt dynamics and on the adjustment of real ULC. One thing is clear: the euro zone will need all policy makers on deck to lift price pressures and sustain its recovery momentum.

[1] Organisation for Economic Co-operation and Development. ‘Trade Union Density.” OECD.StatExtracts. Most recent reported values for each country are 2010 for Portugal and Spain, and 2011 for Germany, Greece and Italy.