“Between the late nineteenth century and the mid-twentieth century, the world’s geopolitical centre of gravity shifted.” Thus begins Michael Cotey Morgan’s pithy essay providing a historical context to the arc of Canadian foreign policy. The evocation of the concept of gravity is telling in a series devoted to articulating choices in foreign policy. Any country’s physical location is immutable, but the gravitational pulls around it are fluid over longish periods of time, represent different facets of geopolitics — economic, political, human — and can be (actually, have to be) understood, managed and even altered.

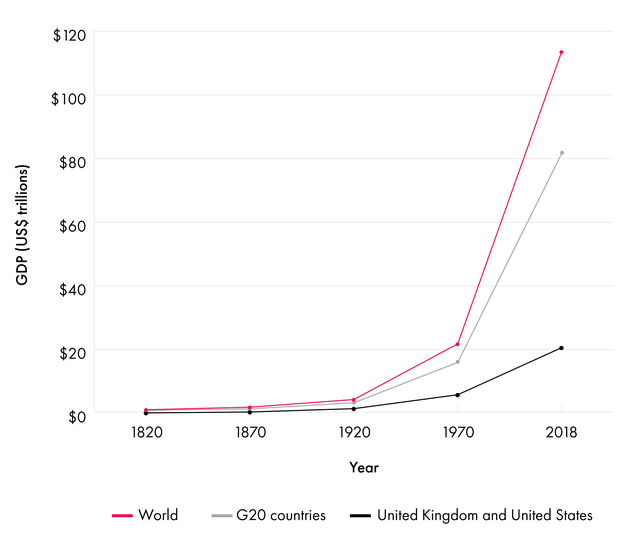

If the principal dilemma for Canada for the better part of the last century was the decline of Great Britain’s pre-eminence and the rise of the United States, consider our predicament today: several centres of gravity now exist, of which the United States, European Union and China are pre-eminent but not exclusive. In addition, former powers mingle with middle powers and emerging powers to give true meaning to the term multipolarity. Today, the Group of Twenty (G20) (which actually comprises 19 countries) accounts for about 80 percent of global GDP and trade and 65 percent of global population. A century ago, the United Kingdom and United States alone would have accounted for the same degree of dominance in global economic activity (see Figure 1).

Figure 1: GDP, 1820 to 2018 (US$ trillions)

This dissonance of power coexists with unprecedented (and near-ubiquitous) technological change driven by digital transformations and big data; high and rising inequality within countries and falling but still appreciable inequality between them; multiple existential threats in the form of climate change, pandemic(s) and a new generation of hyper-weaponry; and a hitherto vibrant but undermanaged form of globalization for which enthusiasm has waned.

No single country can pretend to have control over the situation, but this is not the same as despairing of it. The potential for crises abounds, but so do the opportunities. As Morgan’s and many other essays in this series indicate, Canada is not without the ability and willingness to pursue them. These opportunities are not dichotomous. Focus and prioritization is one thing, tunnel vision quite another.

While Ottawa wrestles with its bilateral relationships anchored by the Canada-US axis, the multilateral dimension is never far behind, for it is axiomatic that smaller players have a visceral interest in a well-functioning, rules-based multilateral order. Rather than take this as a given, Canada has played an outsized role in shaping and running the international political ecosystem. From Brock Chisholm’s seminal headship of the World Health Organization to Ottawa’s influential role in global finance (first by establishing the Bretton Woods system of fixed exchange rates and then by temporarily leaving it, thus providing lessons for its reform) (Bordo, Gomes and Schembri 2009), to Paul Martin’s central role in the creation of the G20 at the leaders’ level, Canada has demonstrated that size and self-interest can combine to create a global public good.

The response to the financial crisis of 2008–2009 is illustrative. Although Canada was affected by it, the economy and financial sector escaped the worst effects (International Monetary Fund [IMF] 2012). (This was not least because of the astute decision by the government of the day, criticized at the time, to prevent large bank mergers [Pearlstein 1998]). The decision did nothing to endear Canada to the US government and its banks, who had long wanted to expand more fully across the border.

Ottawa, in particular Bank of Canada Governor Mark Carney, recognized the main causes of the crisis, which were not a failure in global macroeconomic coordination or trade governance for which we had imperfect but broadly appropriate institutions, although these did play some role, mainly via unsoundly low risk premia across countries (Carney 2008). Rather, the main culprit was weak management of banks and other financial institutions domestically (in particular in the United States) and the resulting interplay with international financial flows, which had become a distinct factor of globalization. The answer was not to retool existing institutions, such as the IMF, but to create a new institution — a process that it was hoped would become an institution over time — dedicated to understanding and managing the spillover effects of the operation of financial sectors.

As it turns out, the wheels had been set in motion by another Canadian during another crisis — Finance Minister Paul Martin, along with US Treasury Secretary Lawrence Summers, was a key proponent of the Financial Stability Forum (FSF) that was created in 1999 by Group of Seven (G7) finance ministers and central bank heads in the aftermath of the Asian financial crisis (Helleiner 2010). Thus was born the Financial Stability Board (FSB), with expanded membership and a broader mandate to promote financial stability. (Between 2011 and 2018, Carney served two terms as chair of the FSB.) Martin is almost certainly correct in arguing that “the FSB should have full treaty status and true universal membership, giving it the weight it requires to be the fourth pillar of the global economic architecture” (Martin 2015).

The FSB story illustrates three important points. First, sound foreign policy must be informed and backed by sound domestic policy. Second, despite the exigencies emanating from a key bilateral relationship, multilateralism cannot play second fiddle to it — indeed, it might be used to counterbalance the gravitational pull of bilateral forces and provide nuance to them. Third, institution building and global governance require commitment, credibility, and all the other hard and soft resources that underpin coalition building.

Currently, two challenges that mirror the emergence of financial sectors as distinct and important players in global well-being dominate. One — climate change — is of relatively long standing. The other — digital technologies and data flows — is more recent. While a plainly existential threat to humanity, I would argue that climate change is well along the path of comprehension, public awareness and range of solutions. One can envisage (albeit imperfect) ways forward without the need for fresh thinking or a new institution. The Intergovernmental Panel on Climate Change and numerous national and international bodies provide authoritative, sometimes real-time analyses of the problem. National policies (for example, subsidies to fossil fuels or incentives to encourage green lifestyles and technology) have to adapt more swiftly to promote the public good, but there is a wide consensus on what the choice set of options looks like. International measures — for example, a border carbon adjustment regime (essentially a differential tax to equalize the carbon value of traded goods when domestic processes vary across countries) to prevent carbon “dumping,” or resources to help developing countries adapt to and mitigate climate change — are easily visualized, and institutional “homes” for them can be readily ascribed.

Not so with the set of issues associated with digital technologies and the use of data as drivers of economic, social and political activity. And here Canada might join, and indeed help create, the global coalition to multilateralize a rapidly evolving situation dominated by a very small number of large and adversarial players.

Firms in the digital space have characteristics that are different from the traditional model of manufacturing-based growth. Participants face high upfront costs and, associated with them, high risk of failure. But success breeds success — marginal costs of reproduction are zero or near-zero, business models are protected by proprietary intellectual property (IP) laws, and, as with big data, the more you have of it the better your product and the better your product the more customers and data you have. There is a first-mover advantage that is accentuated if product or industry standards are developed concomitantly. Success in this area is underwritten by economies of agglomeration and geopolitical strategy. In the high-tech sector, “clustering,” be it of firms, talent, finance or support services, coupled with an active national strategy to nurture and build out the sector, are key to understanding the winners.

Firms in the digital space have characteristics that are different from the traditional model of manufacturing-based growth.

As a result, the world is effectively balkanized into four zones. In the China-centric zone, data is largely controlled by the state, while in the United States, data is largely controlled by the digital platforms. Despite the seeming implacable nature of the competitive conflict between these two countries, their systems have one thing in common — citizens are disempowered when it comes to many aspects of data that might belong to them or at least originate with their actions. The European Union’s General Data Protection Regulation (GDPR) puts the individual at the centre of data governance and provides an appealing policy frame. This still leaves the majority of countries in the world, Canada included, to be drawn into the undertow of one or the other regime.

The consequences, good and bad, of the rise of digital platforms and the “digital-industrial complex” are varied and deep. No single player has the wherewithal to create a global governance process here, yet its benefits would be universal — an analogy with the Bretton Woods system is apt (Medhora and Owen 2020). If, say, Canada joined Australia and India in galvanizing a discussion whose starting point is akin to the GDPR ethos but integrates Chinese and American priorities, there is a fighting chance for a global regime to start forming. To use the FSF/FSB analogy, a Digital Stability Forum might bring in disparate interests and provide the table for meaningful, evidence-based discussion (Fay 2021). Over time, it might become a board and thereafter a treaty-based fifth pillar of the global economic architecture. (Even if the case for digital governance goes well beyond economics.)

Unfortunately, Canada’s domestic policies might not provide the same credible backstopping that our domestic financial policies did a generation ago (Carney 2009), not because of what they are actively getting wrong but because of a general lack of coherent strategy. Arguably, Canada signed on to certain provisions of the Canada-United States-Mexico Agreement (CUSMA) — preventing data localization, and use of the safe harbour provision to shield digital platforms operating in Canada from scrutiny of the content they carry — without having had a national discussion, much less a strategy, about society’s view on such matters in the information age. But at this point, even if the ideal time to act has passed, it is not too late — working to create a global regime, however imperfect, beats the status quo enduring forever. There might also be some wind in the sails of progress as both chief protagonists, China and the United States, understand that prolonged conflict in the pursuit of a zero-sum victory is an inferior proposition, economically and otherwise, to shared governance of the ever-growing pie that is the digital world.

In creating the Digital Economy Partnership Agreement (DEPA), Chile, New Zealand and Singapore have shown what the new breed of international accord might look like. Large gaps — such as the valuation of and regulatory issues around intangible assets such as IP and data — remain to be filled. By joining DEPA early, Canada would play a leading role in establishing the rules of the new game (Ciuriak and Fay 2022).

The current discussion over (COVID-19) vaccine inequity, and controversy to revisit the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), the global regime governing IP and innovation more broadly, provides another example of the changing nature of geopolitics. Vaccines are principally manufactured in China, the European Union, India, Russia and the United States, which have contrasting positions on the TRIPS waiver. Each in its own way has conducted “vaccine diplomacy” to further its strategic aims, and yet there is no meaningful discussion on how to make research and development and manufacturing globally more equitable (and, by the way, also more resilient and efficient) by opening up the innovation-stifling aspects of the current regime.

Today it is pandemics, tomorrow it might be a breakthrough technology to fight climate change. The choice for Canada isn’t choosing between two countries’ views, as it was a century ago, but rather to select from among competing views in a multipolar world to synthesize what is best for it. More often than not, the solution is multilateral or plurilateral, not strictly bilateral. If such dilemmas provoke long overdue national discussions before we dive into seeking global solutions (or, as in the case of CUSMA, having solutions handed to us), so much the better. The geopolitical and geoeconomic world around Canada has changed too much to assume that its national priorities and, yes, even values remain constant.

David M. Malone and I have argued that while there is no question that global cooperation is under threat, a significant part of the reason could be the inability of existing international institutions and processes to adapt to new realities, be they thematic — the emergence of “new” issues such as big data, climate change and pandemics — or geopolitical — the dissolution of a G7-centric world to a G20-centric one and the contested rise of China (Malone and Medhora 2020).

Shaping institutions for the next century is as important for Canada domestically as it is internationally, ideally in that order. While the Bretton Woods conference is — correctly — seen as a battle of ideas and for primacy between the United Kingdom and the United States, dominated by the larger-than-life personalities of John Maynard Keynes and Harry Dexter White, the heads of the two countries’ delegations, Kathleen Britt Rasmussen (2001) has systematically documented how refined Canadian preparation and Canadian proposals were at the conference. A widely cited recent account of the negotiations makes the assertion that “other than the United States, United Kingdom and Canada [italics mine], few delegations came equipped to make intellectual contributions to the architecture of the fund and the bank” (Steil 2013, 229).

Initial reports indicate that Canada played an outsized role in designing and promoting key elements of the unprecedented financial and banking sanctions now crippling Russia’s economy (Fife and Chase 2022). All this country’s resources, talent and avowed penchant for peace, order and good government will have to be marshalled as, in Morgan’s concluding words, “Canadian officials…contend with many of the same challenges that their predecessors faced, reconciling the limits of power with the imperative of independence” and, I would add, remaining influential on the global stage.