This transcript was completed with the aid of computer voice recognition software. If you notice an error in this transcript, please let us know by contacting us here.

David Skok: Hello. I'm David Skok, the editor in chief of The Logic.

Taylor Owen: And I'm Taylor Owen, senior fellow at the Centre for International Governance Innovation and a professor of public policy at McGill.

David Skok: And this is Big Tech, a podcast that explores a world reliant on tech, those creating it and those trying to govern it.

David Skok: A couple of weeks ago, a Danish programmer started sending out these ominous tweets that sounded like they were lifted out of The Sopranos. He alleges that his company received a call from some quote, "mafiosos," who said they'd burned down his store if he didn't pay up. And then he defiantly tweeted, there was no chance in bloody hell he'd pay the ransom. Writing, "I will burn this house down myself before I left gangsters like that spin it for spoils."

Taylor Owen: No, the tech world hasn't gotten that dangerous. The programmer in question is David Hansson, the co-founder of a company called Basecamp. And those mafiosos he's talking about, well, that would be Apple. Here's the short version of this story. Basecamp just launched a premium email service called Hey. They wanted to put Hey on Apple's App Store, but they didn't want Apple to take their usual 30% cut. Apple rejected the app from the App Store, which they say is because the app didn't work properly. But Hansson says it's because Apple operates the App Store like, well, the mob would. If you want to be on their virtual shelves, you better pay up.

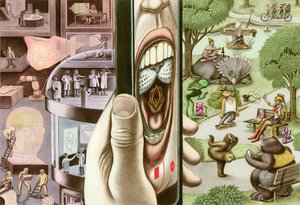

David Skok: Hansson may have a flair for the dramatic, but his tweets hold a kernel of truth. Apple's App Store is the only game in town as any publisher will tell you. If you want iPhone users to use your app, you have to use the App Store and to do that, you have to pay them that 30% cut. The EU just opened an antitrust investigation into the App Store but this story is reflective of a broader issue. Many tech companies are starting to look a lot like monopolies.

Taylor Owen: It's something Matt Stoller has been thinking about for a while now. Matt is the author of Goliath: the 100-Year War Between Monopoly Power and Democracy. Goliath has a history of monopoly power in the United States and Matt argues the big tech is just the latest iteration of the kinds of monopolies that have been dominating the American economy for more than a century.

David Skok: Taking on companies as big as Apple, Facebook and Amazon can seem like an unwinnable fight, but Matt says we've been here before and we can do it again.

David Skok: Matt Stoller, welcome to Big Tech.

Matt Stoller: Hey, thanks for having me.

David Skok: So, convince me that we are truly in an age of monopoly.

Matt Stoller: Sure. so, over the last 25 years, 75% of industries, according to a couple of economists in 2015, have become more concentrated. You can see a crisis of concentration across our political economy in search engines. Google has 95% of the market. Facebook has roughly two thirds of the social media market. You could see it in airlines, cable systems. You'd also see it in smaller markets. I study, I write a newsletter called Big and I look at little markets and one of the markets I saw was cheerleading. Cheerleading is controlled by a monopoly called Varsity Brands, which is owned by Bain Capital. But plagiarism checking software, missiles and munitions, you'll find that in all sorts of different markets, if you just look at them on our micro foundations, you see concentration. You could look at a macro frame, you can look at a micro frame and you just see concentration. And this has a lot of impacts. You can see a much lower productivity growth than we used to have. You also have less firm formation. Venture capitalists talk about things called kills zones, where they just don't want to invest in spaces that are either where a monopoly is or adjacent to a monopoly. You see regional inequality, which is sort of a historical signpost of concentrated monopoly power. You have a billionaire president. What you've seen is kind of the concentration of wealth and power in America, all over the world and the physical manifestation of this is monopoly.

David Skok: Okay. I suspect we'll keep going down this path and you'll convince me more as we go along, but with all the assaults on democracy today, what was it that drew you to look at monopoly power?

Matt Stoller: Yeah, so I got my start thinking about this problem, I guess, during the financial crisis in 2009, I was a staffer for a Congressman who was on the banking committee. And I remember learning about the financial crisis and thinking, oh, this is a technical problem in the banking system. And it took a couple years before I realized, this may sound stupid, but I think a lot of us were stupid this way. It was like, oh, actually this is a political crisis. It wasn't just a financial crisis. Wasn't some technical problem. It was a crisis of banks and corporations who are, turns out they are not neutral technocratic institutions. They are political institutions and how you structure banks and how you structure corporations is a political question. When I started to do research into how we'd handle these problems in the past, I started to see that there was a tie between concentration in the marketplace, which is to say autocracy, because a monopoly is a mini dictatorship over a market and the rise of actual autocracies. This is pretty clear in the 1920s and thirties, you saw a rise of concentration in the US but also globally. And in the 1930s, these kind of went in very different ways. In the US you had a resurrection of liberal democracy and an attack on financial concentration. Whereas in Germany, in Soviet Union, in Italy, you saw a radical concentration either from the government side or from the private industry side. And these are different political systems and they are a result of how we structure our markets as well as who we vote for.

Taylor Owen: You place the moment now in this historical arc over the last 100 years, but it feels like the combination of the Clinton and Obama administration is sort of the origin point of this current generation of monopoly power that you talk about. Can you outline a little bit why the economic regimes of those two presidencies really gave rise to this?

Matt Stoller: Right. I would say there's two main starting points for the current roll up of concentrated private power. One of them is Clinton, you're right, but the other one is Reagan. What we saw really from the thirties when we address the robber baron problem the last time, because we have had this crisis of concentration in the past and we dealt with it through a sustained political attack on the power of concentrated finance. And in the 1970s, sort of a new generation of Democrats and Republicans emerged. These were people that didn't really think about corporate power as a political problem. They just didn't think it was part of politics. And in the 1980s they sort of took over the antitrust agencies and what they started to do was roll up power domestically. You saw roll ups of banks and you saw the explosion of chain stores and just a whole media consolidation. And this was really done under two, there were two basic theories and one of them was the right wing, sort of libertarian ethos. That concentration is good because business leaders that have a lot of money and power know what they're doing so we shouldn't interfere with them. And then the other side was the left wing argument that monopolies are good for the consumer. This was the consumer rights argument, really from Ralph Nader. And that came from some socialists in the 1950s. And so the Republicans were the pro-monopolists and then the Democrats became pro-monopolists and so you didn't have a choice anymore. And the idea behind what Reagan and Clinton and Bush and Obama did is they said, "Well look, the key to running a good society is to have fancy experts with PhDs or with a lot of money who know what they're doing and concentrate power and then let them kind of use that power to make our world better." You can see that embedded in Google's mindset where they want to organize the world's information. That's very much a I know what's good for you framework. It's an ideological framework. And that ideological framework sort of took over, which is why in the end of the Obama administration, you saw this great celebration of the aristocratic Alexander Hamilton and what a genius he was because that's the ideology that they believe in. That's kind of where I draw it from. And now we're in this situation where we have massive accumulations of private power, both in Silicon Valley, but also kind of across our political economy. And the public is very unhappy all over the world and so you have resurrection of older models of political organizing, sort of a soft authoritarianism. And then also this kind of left populism, which is where I come from, the sort of let's decentralize private power. But all of it comes from this basic ideological redefinition of property rights that happened in the eighties and nineties. And that redefinition of property rights said, "We are going to separate out control from caretaking." So now you have these people that have control over these giant systems, but they don't actually have to take care of them. That's the problem of Facebook. Mark Zuckerberg has control over Facebook, but he doesn't actually have to deal with any of the negative problems that emerge from that control.

Taylor Owen: And part of the separation was a regulatory framework that allowed them to function as platforms without liability, right?

Matt Stoller: Exactly.

Taylor Owen: And that emerged in.

Matt Stoller: ‘96.

Taylor Owen: I want to zero in that Obama. Yeah, and what we generally talk about the large tech monopolies really went from small companies at the beginning of the Obama administration with a lot of hype and hope around them to monopoly powers by the end of his presidency.

Matt Stoller: Yeah, that's true. I would bring it back to the late 1970s and eighties, when this ideological shift really took place. We had very aggressive regulation of our media systems, radio, television, the internet, all of these things were based on a media regulatory framework, a telecom framework that decentralized power and prioritized universal service. And then in the 1980s, we started stripping those away. And that's when you saw the rise of AM talk radio stations. That's when you saw the rise of, in the 1990s with cable news and the giant media conglomerates emerged as a result of policy. There were a series of policy choices that enabled those. Then there was the antitrust suit against Microsoft, which prevented Microsoft from controlling the internet and created this explosion of innovation in the early 2000s. But in 2004, the Supreme Court basically got rid of antitrust law in a decision called Trinko. And so over the next from basically 2003 or four, until 2014, when Google, that was Google's first acquisition. They bought a company called Applied Semantics, to Facebook's last major acquisition, which is, I think WhatsApp, you saw basically the big four tech companies bought hundreds of companies without a single merger challenge. And we have laws that are against illegal monopolization and illegal mergers. We just didn't enforce them. And so that period was the period in which it was sort of the end of the Bush administration then most of the Obama administration, where they just believed that the Google guys are cool, they're going to do the right thing. They're building these amazing things so why shouldn't they organize the world's information? And those were really the policy choices they made. There was really no attempt to address Amazon's obvious predatory pricing with diapers.com. There were a whole bunch of things that the Obama administration did to enable this roll up of power. It was really continuity with going back to the Reagan administration.

David Skok: You mentioned the big four and I'm wondering if we can actually fold it into the big five, including Microsoft. Would you walk us through your arguments for how each of these companies function as monopolies?

Matt Stoller: Sure. They're each different, but the basic dynamic. Let's put Google and Facebook together, because they both are, they're basically advertising companies. Google and Facebook are ad companies. And what they do is they are communication networks and traditionally what we've done with communication networks is we've regulated them as public utilities. And we've said, "You're not allowed to discriminate." Maybe we put rate regulations, say we've got to control what you can charge, but we didn't do that with Google. And so what Google does because they traffic in information, we have allowed them to manipulate us through advertising because advertising is just a third party paying to manipulate the flow of information. That's just what advertising. We've had a whole sort of argument about how to deal with that in the media space. But we never had that when we're talking about communication networks and so Google, although Larry Page and Sergei wrote about this in the late nineties, they were like, "You can't run an ethical search engine with advertising." They just were straight up about it. This was before they became billionaires. We have communication networks where they have an incentive to addict us, surveil us and just show us more advertising. And that we're going to have to address that because these communication networks are amazing, but they should serve us. We shouldn't serve them. That's how these guys work, they're communication networks that finance themselves through advertising. Now Amazon is a whole series of basic infrastructure. They're kind of, they're trying to do something similar to what Google and Facebook are doing, except in lots of different spaces. So they put themselves into the underlying infrastructure of a market and then they often will compete on top of the marketplace that they set up and they control. Then they will also leverage that control of a marketplace into controlling another marketplace or another piece of infrastructure. So they have the retail space, they also do logistics and fulfillment. They have a studio, they have a whole bunch of brands that they produce of goods and services and then they bundle it all together with Prime. Of course they have AWS. It's a very complicated institution, but that's the gist is they're trying to become public utility style infrastructure that's not regulated. Then Microsoft, I haven't studied Microsoft as much, but from what I understand, they're essentially doing something similar except in the business software realm. So they're going to kill Slack right by giving away Microsoft Teams or by underpricing Microsoft Teams. They're essentially doing what they were doing in the 1990s, except a little bit more softer and a little bit more nicely. And then Apple, I think they're just your standard monopoly. They have huge amounts of market power in obviously with phones, but then they can most aggressively exploit that power against their suppliers and also against people who have to sell apps through their App Store. You can buy a Samsung phone or you could buy an Apple phone or an Android phone versus an Apple phone. But if you make apps, you basically have to go through the Apple App Store to get your Apple customers. And you have to go through the Google Play store to get to your Android customers, which means that you're dealing with two separate monopolies. Apple's a little bit more, they're just, they're of kind of like your ordinary bandits. They're just trying to stick you up for extra fees. That's more like your standard telecom, whereas Google wants to transform mankind, which is super creepy.

David Skok: I want to come back to Amazon in a second because I know what their argument is, but before I do, what you're talking about in regards to Apple and the phones is the walled garden argument. And would their response, I assume to play devil's advocate here would be, look at the end of the day, the consumer still has choice. When you talk about monopoly, how does that apply when I, as a customer, can go into the Google walled garden or the Apple walled garden or the Samsung, well the Android operating system walled garden? What is it that specifically Apple is doing that nobody else can compete with that that creates a monopoly?

Matt Stoller: Well, from the point of a consumer, it's just hard to move off of the Apple ecosystem. There's high switching costs. There's not a, you can go to Google's ecosystem and that's it. There's a lot of concentration, even though you have a choice, you really only have one other choice. But again, as I said with the app makers, if you make an app, you have to go through Apple's App Store. You don't have a choice. Because a bunch of your customers are going to just be Apple owners, and they're not going to switch to Samsung so they can use your app. You don't have a choice.

David Skok: And in regards to Amazon, their argument would be, look offline we're competing against Walmart, we're competing against Target, we're competing against Alibaba. We only have 1% of the global market share of retail and this delineation between online and offline is a false narrative. How would you counter that?

Matt Stoller: That gets to the underlying tension in whenever you're doing antitrust work, which is, how do you define the market? I think Reed Hastings of Netflix said, "We're competing against sleep." You can always, Mark Zuckerberg, when I think he had a note with him when he testified before Congress and he said, "Oh, we compete against all these other things including free time." It's like, you can always define your market as whatever it might be. But one way to define a market is, is it substitutable? Could you find an easily substitutable good? And I think with Amazon what you'd probably find is that at least for online retail, it really is a separate market than actually going to the store. There are sometimes some substitutes, but it's not easily substitutable. And then for a lot of products that Amazon sells, they probably are a monopoly in terms of consumer facing. But more importantly, if you are a seller, if you are selling through Amazon, there are just a lot of companies and there are firms and people that are highly dependent on Amazon. And they will go out of business without Amazon. In some ways it's a little bit like saying, "Well, that railroad that goes through this one narrow valley that you have to take to get to market. Well, that's not a monopoly because there are other railroads in the country." Well yeah, maybe there are, but it doesn't matter if you need that particular railroad to get where you're going. And I would say that's what Amazon is like in a lot of the sectors that it deals with.

David Skok: So, let's say I accept your premise. These are monopolies. Then the next question is, well, the next counter would be well, monopolies aren't just chosen. They come out of markets as we've discussed. And I guess I'm trying to understand the root causes of the current monopolies that you speak of. There was a long time there, roughly 20 years or so when Jeff Bezos was selling shareholders on a myth. That if you invest in the long-term, we will one day become profitable, but they weren't generating revenue. And then others have kind of taken on the same or similar type of approach. I think of Uber. And then ultimately, perhaps to its downfall, WeWork. But what role do markets and institutional investors and large movers of money play in helping to incentivize this kind of company?

Matt Stoller: The book that I wrote is called Goliath: the 100-Year War Between Monopoly Power and Democracy. And we had a very similar dynamic in the 19 teens and twenties and thirties, where we had what was called the anti-chain store movement, which was largely a movement that was focused on the A&P supermarket, which was kind of the Amazon or Walmart of its day. And what A&P would do is they would, because they had a lower cost of capital, which is what you're talking about with Amazon. They could then go into an area with an independent store and they could under-price them. They could sell goods for less than they were worth that were popular to kill independent store owners and then they would dominate that market. They weren't doing a consumer dominance play, they were actually crushing the suppliers. This is very similar to the Amazon or Walmart problem. They were buying monopoly. So, basically what that is, and it's the same problem we have today is that your ability to succeed in the marketplace is not based on whether you deliver good products or services, it's based on your closeness to Wall Street. What is your cost of capital? And it's also fundamentally destructive because the premise of a successful market economy is that if you take a bunch of inputs and put them together into a new output, that that output should be worth more than the inputs. That's what creates wealth. And we do this through the pricing system. If you're taking a bunch of inputs and you're adding them together and then you're selling them for less than what those inputs are worth, that's net value destructive and that's what Amazon was doing, that's what A&P was doing. It's what WeWork was doing. It's what Uber was doing. It's a whole bunch of, that's what chain stores do. And what they're doing is they're not investing in making better products or services. They're engaging in what's called predatory pricing to acquire market power. And there were laws against predatory pricing partially because of the A&P case. And these laws lasted until the mid 1970s, when Democrats got rid of them. And then you saw the roll up of power in the hands of chain stores and in the hands eventually of institutions like Amazon. Now if you can distinguish between something like Amazon, which actually succeeded at acquiring market power and something like WeWork or Uber, which didn't because it was financed by grifter idiots who then just started engaging in self-dealing. But basically predatory pricing is a form of counterfeit capitalism. You're not actually creating wealth, you're destroying wealth to acquire market power.

David Skok: The WeWork example is a good one in that every VC that I have spoken to in the past three or four months have all said the same thing, which is, "We are now looking for profitability, not growth, we've changed our tune." And so the follow up question is, do you need regulatory or policy changes or is the market in fact, taking care of this on its own?

Matt Stoller: Be careful. I'm not saying that just we need profitability. What I'm saying is that you need, profit should come from making better products or services. Because you can make money engaged in, engaging in predatory pricing. Amazon has made a lot of money engaging in predatory pricing, but they haven't necessarily created that much wealth. They've transferred wealth to themselves by exploiting market power. The key is that is that it's how we structure markets. Do we structure markets so that the people that are closest to Wall Street or closest to concentrated capital get market power? Or do we structure markets so that they're open and so that people can come in and profit by making better goods and services?

Taylor Owen: I feel like that's partly how, where the EU is coming at this in a slightly different direction and probably Canada to a certain degree too, where we can't really break up these companies, but we can change their behaviour or affect their behaviour in our markets.

Matt Stoller: They're just whiny. The Europeans are just whiny about everything and they don't ever do anything. It's really annoying. I'm sorry.

Taylor Owen:

No, no, tell me more. I want to hear more about the path they're going down in this.

Matt Stoller: Like Vestager. Vestager's been working on this, they've been working on this forever and they keep saying, "Oh, we need them to behave." And then they do their annoying, this is what the Europeans always do. They always flex their muscles and come out with meager sort of regulatory policies or fines. And then they talk about European champions and then they do their, all their bureaucratic nonsense, like their trilogues, but they never actually do anything that matters. Google is still dominant. Facebook is still dominant. And show me what they've done to decentralize power. If you contrast that with say Russia. Now Russia is definitely not, they're not AOK in my book in general, but you know what the federal cartel service in Russia did? They had the Android case, which was the same case that the Europeans had. And they just didn't take five years on it. They just said, "No, you can't tie Android to search. And by the way, everybody who has an Android phone who was defaulted into Google search, you have to text them and tell them that they have this other choice Yandex. And you got to do it today." And then Google did it. And now there's a competitive search market in Russia. And it's the only competitive search market in the world really are one of the few where Google is a competitor. And I'm sorry, but you can't tell me that the Europeans who had the same, basically the same case at the same time have been any good when Google is still dominant. The Europeans make a lot of noise, but until I see some real action, I'm not convinced that it means anything.

David Skok: I was going to ask you a question about journalism or information flows in society and the effect of these monopolistic entities, but throwing in Russia and having non-monopolistic entities doesn't give me much confidence in one of the arguments of your book, which is that they're controlling the flow of information in our society.

Matt Stoller: Well, I'm not making an argument that we should be like Russia. I'm just saying that I'm comparing the fact that Europe is doing worse than an authoritarian state on this stuff. I'm just like, let's be honest about how we're doing and it ain't great right now.

David Skok: Well, in the book you write book publishing and distribution media financed by advertising and social media are how we communicate ideas with one another and all three channels are increasingly in the hands of monopolists. That doesn't appear to be the case in Russia. Of course there's other challenges there, but so I'll bring it back to the US example or the North American example. What does this information flow being in the hands of a select few mean for democracy?

Matt Stoller: Well, I think it means bad things. We have, you know, Amazon controls in many ways, the book market and they can structure the flow of ideas and do structure the flow of ideas. I think Google and Facebook both control the flow of news, the flow of information, how we interact with one another. In Brazil, before, you got people who because of the YouTube engagement algorithm, believe that Zika comes from doctors. You know, you have the 2,000 of America's 3,000 counties now have no daily newspaper because Google and Facebook have redirected the flow of advertising that used to go to publishers to themselves. And this is true, this is a crisis all over the world. It's not like, and by the way, this is not necessary, we don't have to do this. This isn't some inevitable consequence of anything. If you look at a different market structure, say the podcast industry, you can see that we can have a scaled market where you have a whole bunch of different diverse voices and you have different advertising networks and it can work. And that's just a question of market structure and market rules. We didn't have to destroy the internet. We don't have to destroy our newspapers and we can get back to a much more open and vibrant market structure for information. We just have to make the choice to do that.

Taylor Owen: All right, on that moderately upbeat note, thanks so much for doing this.

Matt Stoller: Hey, thanks for having me.

Taylor Owen: Big Tech is presented by the Centre for International Governance Innovation and The Logic and produced by Antica Productions.

David Skok: Make sure you subscribe to Big Tech on Apple podcasts, Spotify or wherever you get your podcasts. We release new episodes on Thursdays every other week.