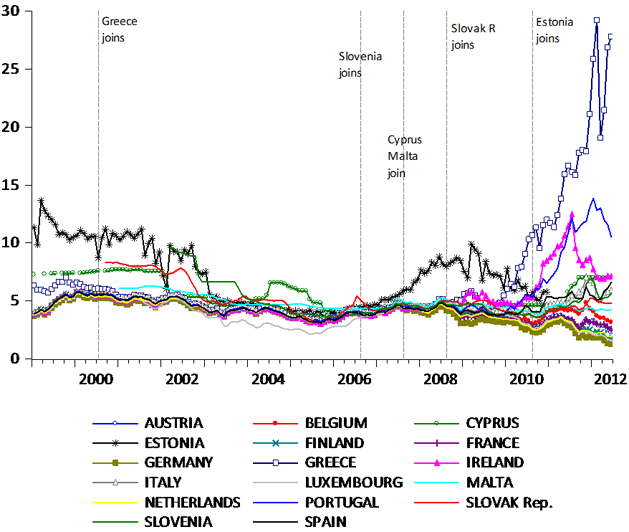

Much ink has been spilled over how financial markets either underestimated the risk of a sovereign debt crisis or simply assumed that, in spite of the restrictions of the Maastricht Treaty, a member in trouble would somehow be bailed out. Either way we see from the graph below, which plots the long term government bond yields (considered the ‘benchmark’ for establishing the credit standing of sovereign debt) that financial markets treated Greek debt, for example, as essentially indistinguishable from German government debt. Until well into 2008, it is almost impossible to see a substantial difference between bond yields in the northern and southern peripheries of the eurozone.

A little explanatory note: here long term debt is usually the yield on government bonds that mature in 10 years or more. Quite often the press has reported yields on shorter maturity bonds as they expire. However, the message below is essentially the same whether the bonds mature in 2 to 5 years or in 10 years.

Although it is not always easy to tell, in the graph below the pattern of long term government bond yields can be seen falling as we see the repeat of countries set to join the eurozone. Since late 2008, the picture has changed dramatically with Greece, and to a lesser extent, Ireland and Portugal having long term debt yielding significantly more than the benchmark German debt.

Source: Author’s calculations based on the August 2012 International Financial Statistics CD-ROM (Washington, D.C.: International Monetary Fund).

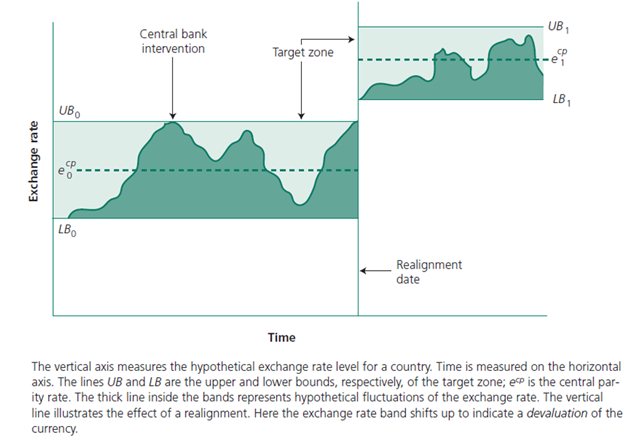

Among the various ailments afflicting the eurozone the relative cost of government borrowing is at the heart of the crisis and is expected to play centre stage when Mario Draghi, President of the ECB, presents some sort of plan on September 6th to narrow the differentials shown above. This made we wonder whether, in an effort to save the eurozone from collapse, an attempt will be made to limit the interest rate spread between the sovereign debt of eurozone members. This would be a system that parallels the target zone exchange rate system in place in the years leading up the introduction of the euro. Then, bilateral exchange rates were allowed limited flexibility within an agreed to target band. In principle, if the exchange rate appreciated or depreciated too much, central banks would intervene to push the exchange rate back into the band. If the pressure to breach the band became intolerable, then EU governments would have to agree to a realignment of the currencies. A hypothetical illustration of how the target zone worked is shown below.

Source: P. L. Siklos. (2006). Money, Banking and Financial Institutions Fifth Edition, (Toronto: McGraw-Hill Ryerson), Chapter 26.

In principle, the ECB can aim for what it deems to be a reasonable spread between the yields on member states’ sovereign debt with allowance for larger or smaller spreads depending on how well each manages its fiscal affairs, that is, a form of conditionality.

Needless to say, this would lead the ECB to stray in a territory that is considered far removed from standard monetary policy. Nevertheless, we seem to be in a era where the arm’s length relationship between governments and their central banks has been blurred and where experimentation is the order of the day.

We will know perhaps a little more about what the ECB has in store on September 6th. Stay tuned.