It’s back!

No, the reference is not to this blog, which has been inactive for several months owing to the exigencies of my day job. The “it” in question is volatility in global financial markets.

The past few weeks have seen wild swings in global equity and bond markets. For much of the year, global investors happily tallied up their capital gains as stock prices moved progressively higher, buoyed by the efforts of central banks around the world to support recovery through quantitative easing that encouraged the bearing of risk. In recent weeks, however, a growing sense of unease regarding global economic prospects has settled over financial markets.

The simple fact is that a malaise continues to grip the global economy six years after the failure of Lehman Brothers pushed output, employment and trade into a vertiginous free fall. The sources of this malaise are, I’d argue, reasonably clear, as are the factors blocking an effective response to them.

A post on risks in the global economy two years ago, here, identified four issues:

- Dysfunctional monetary arrangements in Europe;

- Dysfunctional politics in the United States;

- Opaque politics in China; and

- Retreat from the open, dynamic international trade and financial system globally.

Two years on, a status check and a "mark to market” of the diagnosis are long overdue.

So, where do things stand? This post will look at Europe. Subsequent contributions will cover the other three issues.

Two years ago, there were serious concerns that the Eurozone was on the brink of collapse. At the G20 meeting in Mexico, European leaders were subjected to the censure of emerging market countries that had hitherto been lectured to by the International Monetary Fund as they were in crisis. The tables had turned; and the fear of a serious crisis as Greece or some other member exited the Eurozone was almost palpable.

In the event, of course, the risk of a European crisis receded; the fear misplaced. On this score, the earlier assessment was off the mark. But, recall that in the wake of the G20 summit ECB President Mario Draghi, committing to do “whatever it takes” to save the euro, introduced the Outright Monetary Transaction (OMT) to inject liquidity and restore a modicum of normalcy—not necessarily confidence—to the Eurozone banking system.

Draghi's well-timed intervention reduced the risk of immediate crisis in the Eurozone. However, as noted in a previous post, that intervention has not resulted in a significant improvement in economic prospects. The specter of deflation looms over the continent and economic growth remains tepid, while debt burdens (and uncertainty as to how they will be resolved) constrain growth prospects. My concern two years ago was that the Eurozone is, in effect, a reprise of the "bad" gold standard of the inter-wars (distinguished from the "good," or less-bad, gold standard of the late 19th century), which imparts a deflationary debt-driven austerity spiral that is destroying employment, stalling investment and tearing the social fabric of countries facing Great Depression levels of unemployment.

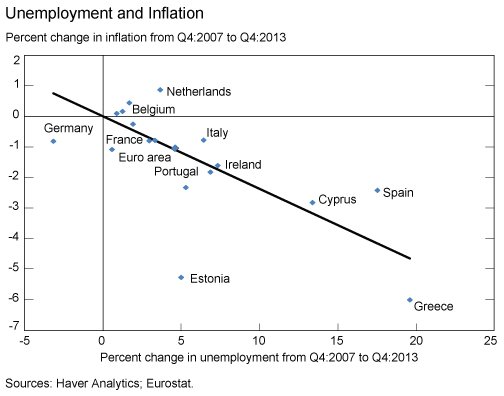

That pessimistic prognosis remains the case, notwithstanding the ECB's efforts to hold things together. As elections for the European Parliament earlier this year made clear, opposition to austerity has increased and political fissures have widened. That isn't terribly surprising (and was implicit in the original post). The policy of “internal revaluation,” as senior European officials enthusiastically referred to it two years ago, was in fact designed to force adjustment through deflation. But, as the chart below shows (from a note on High Unemployment and Disinflation in the Euro Area Periphery Countries), that adjustment mechanism required higher unemployment in what Krugman would say is a “return to (Great) Depression economics.” What is surprising, frankly, is that the situation has not become more polarized; more radicalized.

The chart also shows why Germany is the staunchest advocate of austerity: it alone has benefited from lower unemployment and modest deflation. Cynics might observe that the bitter medicine of austerity helps not the patient taking it, but the doctor administering it.

In any event, the threat of deflation remains and expectations are that the ECB will be required to adopt additional measures, akin to the Fed’s policy of quantitative easing, to reduce the risk of downward deflationary spiral. In early September, Draghi responded to indications of persistent deflationary pressures by cutting interest rates to a record low, pledging to buy private sector bonds, in what might be called quantitative easing "lite," and increasing the negative interest rate on bank deposits at the ECB. A key element of the plan is the purchase of asset-backed securities and covered bonds.

The idea behind the surprise announcement is that existing loans on bank balance sheets are blocking up new lending that would stimulate growth and create employment. In this respect, the measures have the same objective as plans mooted by the ECB earlier in the year to provide low interest rate loans to banks at longer maturities for onward lending to non-financial firms. There is no doubt that non-performing loans (NPLs), which since the crisis have increased in many Eurozone countries, ties up capital that could otherwise be used to finance new loans. The initiatives announced in September would do this by taking loans off bank balance sheets directly and packaging them in such a way to ensure that the ABS meets the ECB's criteria for holding assets, or indirectly. The problem, though, is that it is unclear that such measures will be effective. High NPLs and uncertainty about future prospects may reduce banks' willingness to lend, with banks preferring the relative safety of cash or Treasuries, while firms may exercise the option value of waiting.

Recent volatility many reflect uncertainty over Draghi's ability to follow through on his "do whatever it takes" commitment. Following his July 2012 pledge and as central banks around the globe conducted QE, volatility was suppressed and European banks, including those in the worst-hit periphery countries, were able to issue bonds at much more favourable terms as investors engaged in a search for yield and raise capital. But questions remain. Some commentators question the wisdom of the ECB's plan to purchase ABS, fearing that it entails direct lending to the private sector and transforms the ECB into a bailout agency with potential risks to its price stability mandate. Moreover, while the OMT had the blessing of Eurozone leaders, it is less clear that all partners endorsed Draghi's September surprise. In between the two announcements, meanwhile, the German constitutional has declared OMT illegal.

Bond buying would be legal the court ruled if it was strictly limited, bonds were repaid fully, and bond buying did not distort market prices. Here's the rub: the purpose of the OMT pledge is to shift expectations—to move the economy from a "bad" equilibrium (deflation risks and stagnation) to a "good" equilibrium (modest inflation and growth). But it can't do that, arguably, if there is uncertainty regarding the scope of the commitment. The situation would be somewhat like a central bank lender trying to stop a panicked run on a solvent but illiquid bank by covering the first "x%" of deposits. A lending of last resort window of that kind would not arrest the bank run since individual depositors would not if they would be protected; since illiquidity can lead to insolvency, the rational strategy for all depositors is to rush to the exit.

So, what is the near-term outlook for the Eurozone? Time will tell. It is safe to say, however, that more volatility can be expected in the weeks ahead.

On Sunday ECB officials released the results of a comprehensive review of bank solvency. The hope is that the review will dispel the lingering doubts regarding bank solvency that may be impeding recovery. In the preceding weeks and months, officials sought to lend credibility to the tests, labelling them as rigorous in contrast to earlier tests that were widely viewed as too lenient and thus lacking credibility.

The results show that 25 banks failed to meet the minimal capital requirements; with a total capital shortfall of €25. Markets reacted calmly to the news, perhaps in part because many of the banks that failed the tests at the time of their review have already raised additional capital. That being said, it will take some time for analysts to review the results of the tests and come to an assessment of whether the process is in fact credible. If not, expect more turbulence.

What is the likelihood of that outcome?

Full disclosure: I have no idea. That being said, there are two reasons to suspect that markets will set a fairly high bar in assessing the results. First, as already noted, the first stress tests were not viewed as credible, possibly leading to skepticism regarding the second round of tests: "fool me once, shame on you; fool me twice, shame on me.” The second reason markets may be somewhat jaded involves the incentives at play. The more rigorous the stress test, the greater the likely capital shortfall and the need for financial backstops should the announcement of the results lead to bank failures. In this respect, while Eurozone countries have made progress towards a single regulatory authority, less progress has, arguably, been achieved in designing resolution authorities. The Single Resolution Authority has a "war chest" of only €55 billion (about twice the level of the capital shortfall identified by the stress tests); albeit it can borrow resources, if necessary. But that is to be contributed by member countries over 10 years and, in any event, doesn't go into effect until 2015. Compare this with U.S. approach to bank stress tests, which ensured (coerced?) banks would be capitalized if they were found to have insufficient capital. Some investors might worry that, absent a clear, credible backstop to deal with the potential effects of a rigorous test, incentives may be skewed to weakening the tests. Such an effect, if operative, would raise the bar in terms of credibility.

Of course, it is possible that Draghi’s OMT has bought enough time for banks to have filled gaps in their capital requirements. And, if the tests are deemed credible, it could reduce the required rate of return on bank capital, allowing them to more easily raise additional capital and expand lending, in a kind of virtuous circle. This would dissipate some of the fog of uncertainty that is holding back investment, employment and recovery in Europe.

But will firms invest if there is weak demand?

That is the question that lies behind ECB President Draghi’s proposal for a new compact among Eurozone countries. The compact would exchange commitments of more structural reforms for less austerity. Such a package would help provide demand today and help transform the Eurozone into an optimal currency area (see the discussion here) tomorrow. The idea received the implicit blessing of the IMF Managing Director at the recent IMF-World Bank meetings in Washington. Not surprisingly, however, it has received a frosty reception from the German government. After all, from the perspective of the authorities in Berlin, the compact would require them to loosen current fiscal policy in return for future structural reforms that may, or may not, be realized. And, in any event, the status quo has led to both lower inflation and lower unemployment (see the chart above), so fears of deflation are misplaced.

All to say: monetary unions that fail the conditions for an optimal currency area should have ex ante fiscal arrangements to respond to shocks that have asymmetric effects ex ante; negotiating such arrangements after the fact can be difficult. In this respect, getting governance right is critical for restoring growth and prosperity in the new age of uncertainty.