(This post was co-authored with CIGI Research Officer Amanda Kristensen)

… say first what cause Mov'd our Grand Parents in that happy State, Favour'd of Heav'n so highly, to fall off From thir Creator, and transgress his Will For one restraint, Lords of the World besides? Who first seduc'd them to that foul revolt?

John Milton Paradise Lost, Book I

The previous post noted that Europe confronts a difficult dilemma having gone ahead with a monetary union for a group of countries that did not constitute an optimal currency area (OCA). It is possible that members undergoing “internal devaluation” will persevere with needed real-side adjustments, regardless of the cost. But this process is likely to take some time, and the history of similar adjustment challenges is filled with examples of “adjustment fatigue” and program failures. To reduce this risk, Europe could build the institutions that would help sustain the monetary union. In this respect, the crisis in the euro zone may not be “wasted”, mindful of the admonition of Rahm Emanuel, President Obama’s former Chief of Staff, and Europe will coalesce around meaningful, effective institutional reforms. The danger, however, is that the architects of the euro zone will assume that their response to date – the pan-euro zone fiscal compact – will suffice. That, sadly, is unlikely.

The institutions that would support the current configuration of the euro zone would be built on existing agreements. The starting point is the Maastricht Treaty – the “constitution” of European Monetary Union. The treaty and subsequent agreements lay three key pillars for monetary union: a rule against excessive deficits and public debt levels, a “no bail out” clause that would make member governments responsible for their own debts, and a prohibition against the monetization of government debt (unsterilized ECB purchases of members’ debt).

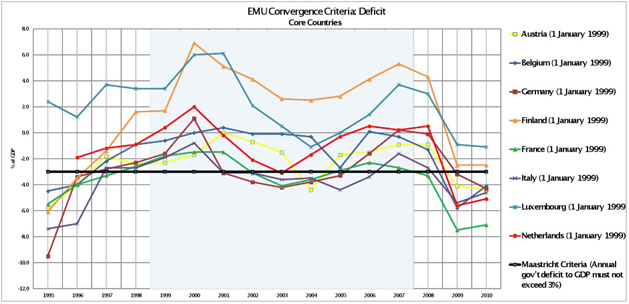

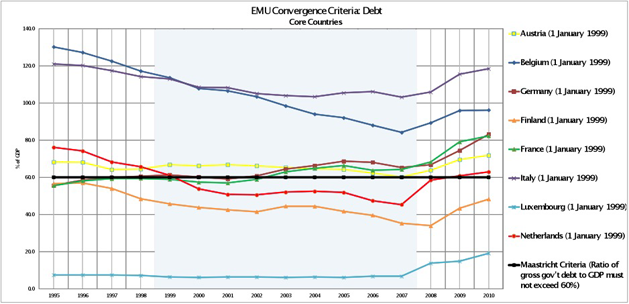

The first of these pillars was toppled when Germany and France violated the rule against excessive deficits several years ago (below).

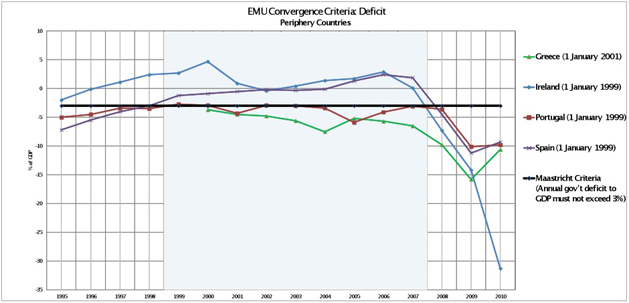

What is interesting is that, as the chart below shows, with a key exception, the periphery countries – some of which are now castigated as profligate – demonstrated more fiscal discipline before the crisis than the three largest members of the so-called “core”.

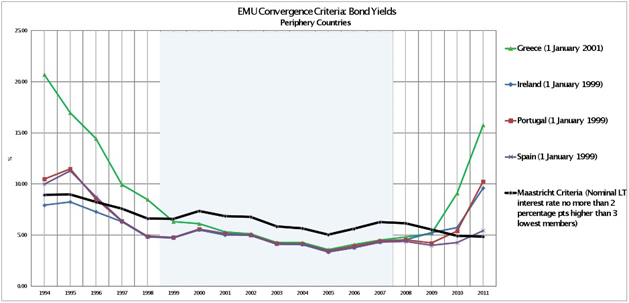

With the core countries blithely in violation of the deficit criterion, it is not unreasonable to assume that private lenders assumed that the Maastricht rules were to be interpreted “broadly”. Hence, subsequent lending to Greece and others may have been supported by the anticipation that a bailout would be forthcoming, should the need arise. In the run up to the global financial and economic crisis, that expectation supported too much debt, priced on terms that were far too generous (below).

But interest rates on Greek debt were converging on German long-term rates even before Greece joined the euro zone. The economics of this effect is relatively straightforward: with forward-looking financial markets and with exchange rate risk eliminated by prospective monetary union, interest rates would differ by perceived difference in default risk. In hindsight, of course, it is clear that private investors were not pricing risk appropriately. This might have reflected persistent errors in risk assessment that assigned credit ratings to members of the euro zone in anticipation of extraordinary support measures, should they be needed, together with the fact that institutions were “incentivized” to lend by regulatory regimes that reduced capital requirements on highly-rated sovereign debt. Ironically, frameworks that were intended to promote a better pricing of risk led to the opposite result.

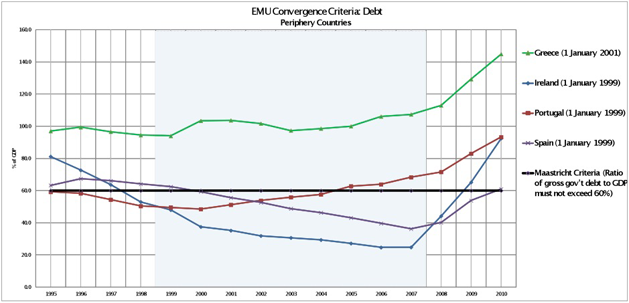

Where would investors get such a notion? Consider another “notable exception” to the EMU convergence criteria (below). Based on its prolonged and unaddressed violation of the rule against excessive debt, it would not have been unreasonable for private investors to conclude that Greece gained admission to the euro zone because of special considerations and that it would receive special treatment if the need arose.

Of course, this effect might not have the devastating result that it did had the no-bail out clause been respected. But the architects undoubtedly hoped to avoid the humiliation of a disorderly exit from the euro zone; particularly after entry requirements were waived for what, frankly, were political considerations. Perhaps they discounted the risk of a shock. Regardless, the need for bailouts did, in fact, arise, and the bailouts of Greece and Portugal have pretty much validated expectations that the prohibition against “no bailouts” would not be respected.

The first two pillars were toppled.

The third and final pillar of European monetary union, the “no monetization of government debt” rule, remains standing. This pillar is, clearly, the one that Germany feels most strongly about (given Germany’s rather unfortunate history of hyperinflation in the 1920s and all that followed).

Last year, Jean-Claude Trichet, then-President of the European Central Bank, was adamant that the ECB would not finance budget deficits of the periphery. Trichet was loath to extend extraordinary financing from the EBC’s balance sheet, even as indications of growing problems in the financial system and calls for the ECB to act as lender of last resort to Europe’s banks multiplied. (Though, to be fair, he had to be mindful of the largest member of the euro zone, which has jealously guarded the independence of central banks.) Everyone can agree that a central bank should not make unsterilized purchases of government debt. This is because of the fact that, through the ‘miracle’ of double entry bookkeeping, such purchases lead inevitably to the expansion of the balance sheet (if assets of the central bank increase, so too must its liabilities—which comprise commercial bank deposits and currency in circulation). And that, historically, has been the path to hyperinflation. This explains German intransigence.

The dilemma for the ECB was that, notwithstanding Trichet’s impassioned defence of the ECB’s balance sheet, it was dynamically inconsistent for it not to provide liquidity in response to the threat of dysfunctional markets. This term refers to the fact that, under certain conditions, actions that may be optimal ex ante, may become suboptimal (or positively harmful) if implemented ex post. That is to say, it may not be dynamically consistent to follow through on a pre-existing commitment. Threats to enforce the commitment, meanwhile, may be viewed as incredible.

In a sense, given the failure of the first two pillars, the challenge that Mario Draghi, the new President of the ECB, faced late last year was whether it was credible for the ECB to enforce the third.

As the risk of dysfunctional financial markets increased, he could have allowed a disastrous credit collapse (the most relevant analogue being the 1929 Fed) and all that might entail, or provide the liquidity to European financial markets to quell the panicked ‘rush for the bond market exits’. The latter response is fully consistent with the role of a central bank and could be endorsed by any sensible central banker that is not unduly governed by dogmatic prejudices. Europe was in the midst of a liquidity panic; if not addressed, that thirst for liquidity could have unleashed a chain of events of far-reaching consequences. Moreover, ECB intervention need not lead to hyperinflation, or even inflation, if after relative calm is restored the balance sheet is reduced.

Fortunately, Mr. Draghi is free of dogmatic prejudices. And very shortly after taking the reins of power at the ECB, he announced a new lending window, the long-term refinancing operation (LTRO) that provides banks ECB liquidity for three years. Since the announcement of the initial tranche of LTRO financing (followed a subsequent tranche) financial markets in Europe have stabilized (actually, rebounded on an increased appetite for risk taking – but that is another story).

Before he could make the announcement, however, Mr. Draghi had to engage in a game of brinkmanship with Germany and other euro zone members. He had to demonstrate that ECB “financing” would be accompanied by “adjustment” in the guise of a strengthened fiscal compact. Success in a game of brinkmanship belongs to those who can convince their adversary of their determination to prevail, or go over the cliff trying. But this intransigence must be balanced by the offer of an opening or path away from the precipice. Mario Draghi deftly provided that alternative, and at the EU summit in early December EU leaders agreed to a strengthened fiscal union that provided the ECB the exit it needs to act as a lender of last resort.

While the LTRO has bought Europe time to complete a Greek debt exchange, it will not be a permanent solution. After all, fundamental changes in terms of a strengthened fiscal constitution require ratification by the people, as Ireland has demonstrated. And, since leaders can agree and the people reject, anticipate continuing uncertainty. Moreover, the fiscal compact does not provide for risk-sharing between regions in a monetary union that, for the foreseeable future, fails the OCA test. It entails more austerity in the hope that improved public finances will restore confidence, even as output is reduced and the social and political fabric of society is torn. As a result, the willingness or capacity of the ECB to provide a lender of last resort facility will be tested again.

A reader of the previous posting notes: “The first [generation] leaders of the [euro] zone hoped that a crisis like this would take the zone closer to federalism: it may still happen, as there is no other way to secure the achievements. Not sure that the struggle to overcome these problems... constitute a ‘March of Folly’ -- as much as does a belief that 'expansionary austerity' will set things right.”

I agree. But allow me to return to Milton’s question: “Who first seduc'd them to that foul revolt?”

It may be cynical to note, but from 2003 onward five of seven “core” members failed the EMU convergence criterion on debt (below). Compare that with the performance of the so-called profligate “periphery” (above). As the Chinese proverb has it: a picture (or two) is worth a thousand words.

Data courtesy of Eurostat http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home/