South of the Rio Bravo, US President Donald Trump is feared, except when it comes to Javier Milei, Argentina’s libertarian president. Milei is counting on Trump to sway the International Monetary Fund (IMF) into lending fresh money to its largest debtor, Argentina, which owes it US$44 billion.

Trump and Milei share common ground: both champion dreams of making their countries “great again,” disdain climate policies and present themselves as political outsiders. Yet their approaches diverge sharply.

Milei is a firebrand free-market libertarian determined to dismantle the state, while Trump reveres tariffs — “the most beautiful word in the dictionary” — and wields them to pursue his “two sacred rules: buy American and hire American.”

Despite their stark differences, Milei and Trump get along remarkably well. During his campaign, Milei pledged to replace the Argentine peso with the US dollar. He hasn’t (yet) followed through, but once in office, he lost no time aligning Argentina fully with the United States (and Israel), even becoming the first head of state to visit Mar-a-Lago to personally congratulate Trump on his victory.

Taming Argentina’s Inflation

When Milei assumed office on December 10, 2023, Argentina teetered on the edge of hyperinflation. The government faced a fiscal deficit equal to five percent of Argentina’s GDP, funded largely through unchecked central bank emissions. Annual inflation had surged to a staggering 211 percent, the peso was artificially propped up by a spaghetti bowl of capital controls (ripe with corruption opportunities) and the central bank grappled with negative reserves of about US$10 billion.

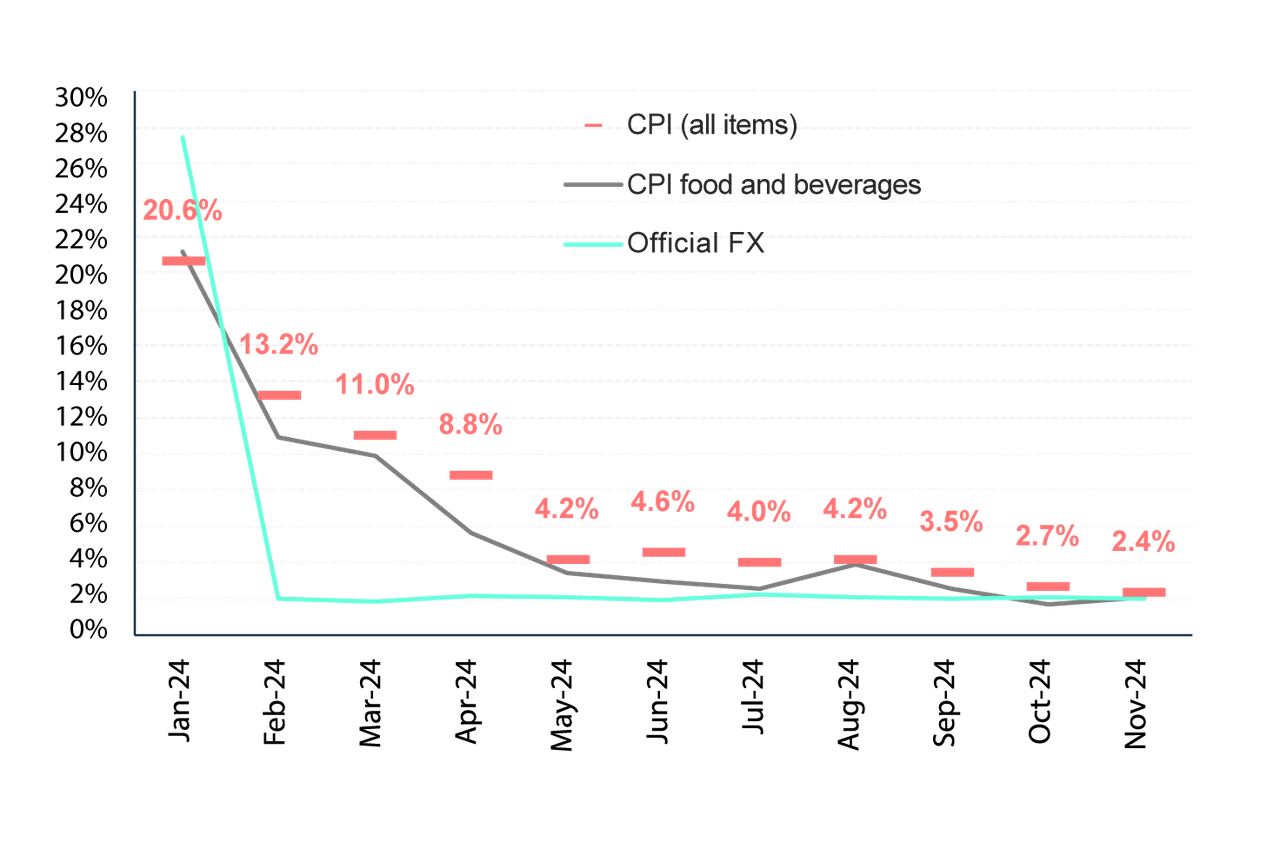

Figure 1: Consumer Price Index, Food and Beverages, and Official Federal Exchange Rate

Milei began his term with a bold 54 percent devaluation against the US dollar, followed by steady monthly devaluations of two percent (and of just one percent from February 1). Inflation initially soared, but, by freezing public salaries and pensions, he managed to eliminate the Treasury’s deficit in just 30 days — largely thanks to inflation itself. Monthly inflation has since dropped to 2.4 percent, which is still high but tolerable by Argentina’s standards.

The social cost, however, was steep. Poverty surged by 10 percentage points, reaching 54 percent of the population, though it has started to decline. Surprisingly, despite these hardships, Milei’s political support remains strong as inflation-battered Argentines recover hope.

However, doubts linger over the sustainability of Argentina’s recovery. The peso has become overvalued again, even as the US dollar strengthens and emerging-market currencies falter.

This appreciation has helped tame inflation, a key factor in Milei’s enduring popularity. Yet this strategy bears a familiar risk. Artificially propping up the peso as an “anchor” to combat inflation is a well-trodden path in Argentina — one that has historically ended in a balance of payments crisis.

Will This Time Be Different?

Convinced that precedents don’t apply, Milei’s administration touts “a new Argentina” that has regained fiscal discipline and embarked on a libertarian crusade to dismantle excessive regulation.

However, while slashing red tape might eventually boost competitiveness, structural gains take time. Meanwhile, Argentina’s crumbling infrastructure urgently requires investment — a need that is unmet as the government freezes expenditures in public works.

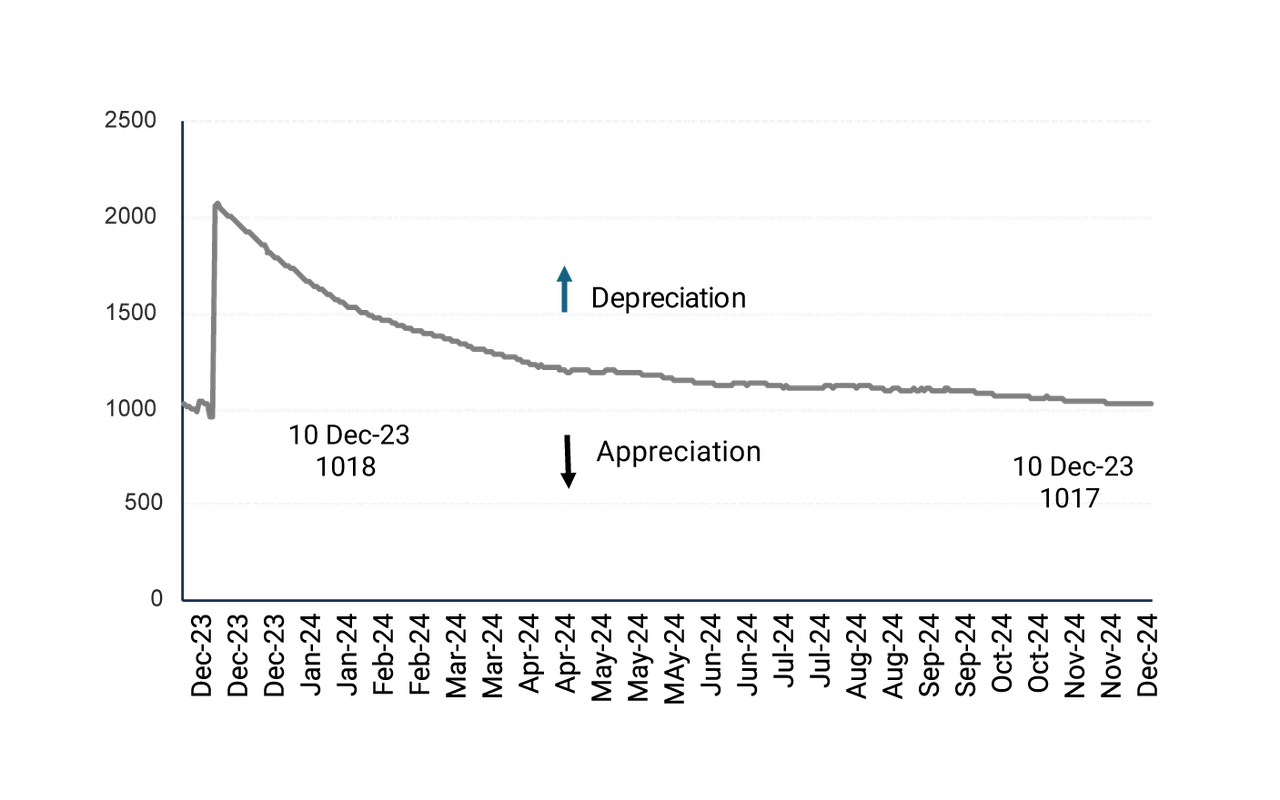

Figure 2: Multilateral Real Exchange Rate during Milei’s First Year of Government

Thus, the peso’s appreciation isn’t driven by improved competitiveness but by speculative carry trade operations. The government’s firm commitment to a two percent monthly depreciation to the US dollar, coupled with a new tax amnesty, has lured Argentines to pull greenbacks from their dollar-stuffed mattresses to invest in pesos. However, this strategy hinges on short-term profits. At the first whiff of a peso devaluation, these investors are likely to revert to their trusted greenbacks.

Fully aware of the risks, and with the central bank’s still negative reserves, Argentina’s finance minister, Luis “Toto” Caputo, has chosen to maintain the capital outflow restrictions inherited from the previous left-leaning Peronist administration. However, Caputo knows that curving inflation may not suffice to convert Milei’s current political popularity into a win in October 2025 legislative elections. Economic stabilization alone might not outweigh rising concerns about unemployment and poverty.

Milei’s fiscal rigour initially deepened Argentina’s recession, intensifying Argentines’ anxiety over unemployment and poverty. While the economy is beginning to show signs of recovery, sustaining the momentum will require attracting investment in job-creating industries. Yet capital controls remain a stumbling block, deterring investors who want to be reassured that their capital can exit as easily as it enters.

However, lifting these controls under an overvalued peso could reignite Argentines’ enduring love affair with the US dollar, potentially triggering a sharp devaluation that could wake up Argentina’s inflationary reflexes.

Milei Is Counting on Trump

This is when the IMF and the illusion of a Trump-engineered bailout enter the picture. Caputo is knocking at the IMF’s door for fresh funds to shore up reserves and enable a smooth transition to a floating peso. However, the IMF is unenthusiastic about allowing Argentina to use its dollars for propping up an overvalued peso.

Milei is betting on his influential ally. While the United States holds the largest sway at the IMF, the fund is not a US government agency. EU countries collectively control 30 percent of voting power, and Milei’s vocal backing of Europe’s far right and his hint at pulling Argentina out of the 2015 Paris Agreement could complicate Trump’s efforts to sway the fund. Overcoming the IMF’s technical reservations about Argentina’s exchange rate policy will demand more than just Trump’s influence.

Moreover, given Trump’s transactional instincts, Milei’s pledge of loyalty to the United States may not be enough. Securing Trump’s support may come at a price.

Argentina sits uncomfortably with Mercosur, the South American customs union led by Brazil. Milei has recently called it “a prison” and is pushing for a bilateral free trade agreement with the United States, a move that could imply dismantling Mercosur. This would directly undermine Brazilian President Luiz Inácio Lula da Silva, who is spearheading efforts to create a BRICS (Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran and the United Arab Emirates) currency to challenge the US dollar. Trump, who has threatened

100 percent tariffs in retaliation, might see weakening Lula — and, by extension, the BRICS bloc — as a strategic win.

This article was originally published by the Official Monetary and Financial Institutions Forum.