The Group of Twenty (G20) finance ministers and central bank governors are planning on discussing the regulation of cryptocurrencies during their meeting in Buenos Aires. The announcement of joint action to advance such regulation could cause the prices of virtual currencies to fall and volatility to increase.

The determinants of cryptocurrency price formation are not well known. Some studies have found that price is determined by demand factors and speculative behaviour. While other researchers suggest technological factors — such as the amount of computation power required to mine tokens — form the underlying value of the currency. The price determinants also appear to vary depending on the period of analysis, and evidence suggests that the drivers of cryptocurrency prices have changed during the asset class’ short existence.

The regulatory treatment of cryptocurrency exchanges affects the price, too. One study has found that exchanges that don’t require identification to create an account, and therefore are not following anti-money laundering or know-your-client regulations, post higher cryptocurrency prices than exchanges that do. These results provide some evidence that cryptocurrencies derive value from serving as a more anonymous, borderless means of transactions, which has benefits for criminal activity and for individuals who place a very high value on their privacy.

A simple analysis of the impact that regulatory policy announcements had on the price of 13 cryptocurrencies reveals more about the relationship between cryptocurrency regulation and the market.

This analysis uses a quasi-event study methodology, as well as data from both Cryptocurrency Market Capitalizations and Coindesk to isolate the reaction of cryptocurrency returns and price volatility on the dates of regulatory events by key countries. Key countries were defined as the 20 countries with the largest number of nodes in the Bitcoin network: the United States, Germany, China, France, Netherlands, Canada, the United Kingdom, Russia, Singapore, Japan, Hong Kong, Australia, Switzerland, Sweden, Republic of Korea, Ukraine, Lithuania, Italy, Spain and Ireland.

The analysis covers four types of regulatory events:

- an announcement by key policy makers or the legislature to explore regulation or introduce legislation to regulate cryptocurrency-related activity (includes virtual currency exchanges, initial coin offerings (ICOs), custodian wallets and derivative products);

- the imminent passage or passage of legislation to regulate cryptocurrency-related activity;

- a discussion, proposal or plan to enforce regulation by financial regulators; and

- action taken by financial regulators or governments to control cryptocurrency-related activities.

Not included are positive regulatory actions, such as the recognition of cryptocurrency as a legal means of exchange, or announcements to allow the creation of virtual currency derivative products. Also excluded are warnings to investors about the potential dangers of investing in cryptocurrency markets (which do not constitute regulatory action or proposed interventions) or actions to shut down fraudulent activities related to digital tokens. There were a total of 57 regulatory events during the sample period that fit the definition above.

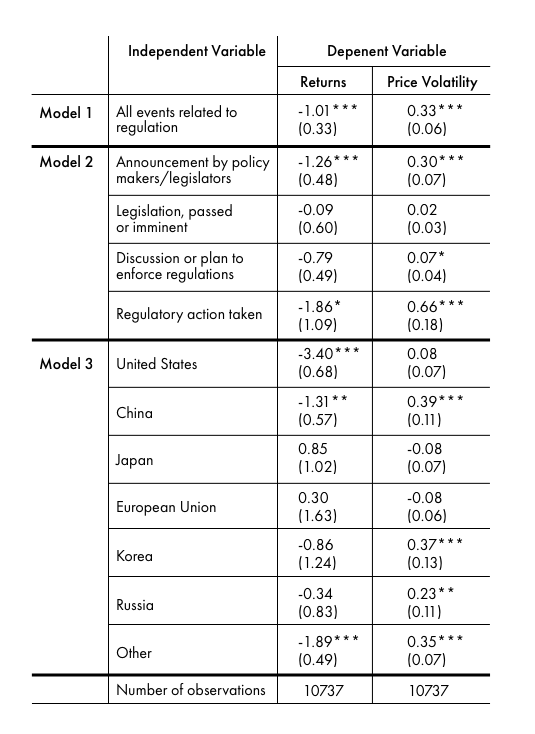

Table 1 shows the results of the regression analysis. The impact of regulatory events are also separately identified based on the different types of events (as laid out in the bullet points above), and the source country of the regulatory event.

In general, the results suggest that regulatory events decrease cryptocurrency returns and increase price volatility — supporting the view that cryptocurrencies derive some value from anonymity and lack of regulation.

Action taken by regulators and announcements by key policy leaders or legislators to explore regulation have the largest impact on cryptocurrency returns and price volatility. This is to be expected: as financial markets are forward looking, they price information into asset prices when it is received. Only new information, such as announcements by policymakers or legislators, or shocks from regulatory actions (like banning ICOs in China) are likely to have an impact on the market. Therefore, only new information announced by G20 policymakers is likely to impact the market.

Table 1: Impact of Key Events on Cryptocurrency Returns and Price Volatility

Announcements by US policymakers have the largest impact on cryptocurrency returns but little effect on price volatility. For example, there was a dramatic drop in cryptocurrency prices on July 25, 2017, the day that the US Securities and Exchange Commission (SEC) released an investigative report confirming that the sale of virtual tokens are subject to federal securities laws, as well as an investor bulletin warning the public about risks of investing in ICOs. More recently, increased scrutiny of cryptocurrency hedge funds by the SEC have been pointed to as a partial cause of the recent decline in the price of cryptocurrencies.

Since the United States has yet to take any significant action to regulate cryptocurrencies-related activity, it is not surprising that announcement from US officials have not sparked significant price volatility. On the other hand, announcements or actions taken by China and South Korea have had the largest impact on volatility. Given China’s hardline approach to choking cryptocurrency activity and the swift implementation of regulation in Korea over the past few months, these results suggest that firm action to control cryptocurrency-related activity might be one of many causes of the market’s volatility.

More significant efforts to regulate cryptocurrencies among a group of major economies — such as the G20 — could send the cryptocurrencies market squealing, causing return-on-investment to fall and price volatility to increase.

Then again, cryptocurrency prices have already fallen dramatically over the past few months since French Finance Minister Bruno Le Maire first announced he wanted to discuss cryptocurrency regulation at the G20 meeting. Investors may indeed be anticipating regulatory action and already have priced it into the market.

This analysis can’t offer a prediction or investment advice — again, the price determinants of cryptocurrencies remain unknown and appear to be changing over time — but it does raise a red flag. Cryptocurrency prices are sensitive to regulatory efforts that impact trading and storage activities. And if a lack of oversight by centralized authorities is indeed one source of the value of these assets, efforts to regulate the market by 20 of the world’s largest economies will probably not treat investors kindly.