The fourth Taiwan Strait crisis has spiked US-China tensions at a parlous moment for the world. The crisis was triggered by the brief visit to Taipei of Nancy Pelosi, the speaker of the US House of Representatives, and China’s escalation of military exercises around Taiwan (including live-fire drills in six “exclusion zones” around the island) in response. It has continued to simmer, if not boil, with no obvious end in sight.

Compared to the three previous Taiwan Strait crises — the first two saw open kinetic warfare and the third saw the dispatch of two US aircraft carrier groups to the region — this one might be written off as mostly histrionics in a teacup, based on developments to date. Neither the visit of Pelosi nor the follow-up visit by five US Congressmen, led by Ed Markey, materially changed anything — politically, economically, militarily or geopolitically (for a deeper dive into the political calculus behind Speaker Pelosi’s visit, see Amanda Hsiao’s analysis).

That said, the scale and location of the military exercises that accompanied China’s subsequent rhetoric has represented an escalation. China presented this as a response to Pelosi’s rank as second-in-line to the presidency: “[Speaker Pelosi’s] visit to Taiwan in any form and for any reason is an escalation of official exchanges between the U.S. and Taiwan and a major political provocation.” From this perspective, China presents itself as playing tit-for-tat, which is stabilizing, since it implies what we have seen to date will be it. Alternatively, Kurt Campbell, deputy assistant to the president and coordinator for the Indo-Pacific, stated that “China has overreacted, and its actions continue to be provocative, destabilizing, and unprecedented.” The White House announced further steps would be taken. Richard Haass concurs that China’s response was an “overreaction” and suggests that the scale and complexity of the response means it had long been planned and the Pelosi visit was just an excuse to escalate the military pressure.

Accordingly, the moment is pregnant with potential — almost all of it bad, from a longer-term perspective. The crisis is, in the first instance, political. However, it risks transitioning into an economic crisis and, in the worst-case scenario, military conflict. The larger question is whether it has pushed the West’s relationship with China past a point of no return.

Given the overriding role of technological capability in determining outcomes in all these dimensions, the critical factor is China’s technological trajectory. Short-term, the key technological area is the production of leading-edge computer chips, where the United States, China and Taiwan are intricately entangled because of, first, US dependence on the production of chips by Taiwan Semiconductor Manufacturing Company (TSMC), and second, US technology export restrictions that deny Chinese access to TSMC products and are driving China to develop its own capabilities without reliance on TSMC or Western supply chains. In the longer run, the main question is: What are the implications for Western policy of China developing those capabilities?

The Political Dimension

Formally, the relationship across the Taiwan Strait is one of a frozen conflict, as there has been no formal termination of hostilities in the Civil War between the Republic of China (ROC), which was the incumbent government in China at the end of the Second World War, and Mao Zedong’s revolutionary forces, which resulted in the retreat of the ROC to Taiwan and the establishment of the People’s Republic of China (PRC) as the government on the mainland in 1949. The lack of conclusion to the Civil War is alluded to in article 7(1) of China’s 2005 anti-secession law, which refers to “the state of hostility between the two sides.”

Article 8 of this law goes on to state: “In the event that the ‘Taiwan independence’ secessionist forces should act under any name or by any means to cause the fact of Taiwan’s secession from China, or that major incidents entailing Taiwan’s secession from China should occur, or that possibilities for a peaceful reunification should be completely exhausted, the state shall employ non-peaceful means and other necessary measures to protect China’s sovereignty and territorial integrity.”

The United States is the third key party in the relationship. When it transferred recognition from the ROC to the PRC in 1979, it adopted the Taiwan Relations Act (TRA). The TRA states that the US decision to establish diplomatic relations with the PRC “rests upon the expectation that the future of Taiwan will be determined by peaceful means and that any effort to determine the future of Taiwan by other than peaceful means, including by boycotts or embargoes is considered a threat to the peace and security of the Western Pacific area and of grave concern to the United States.” It also commits the United States to provide Taiwan with defensive arms and to maintain US capacity “to resist any resort to force or other forms of coercion that would jeopardize the security, or social or economic system, of the people of Taiwan.”

There is, accordingly, no visible path to formal Taiwan independence that does not go through war. The present Taiwan government rejects the PRC’s offer of reunification on the basis of the “One Country, Two Systems” model, considers itself to be independent already, and does not push to change its status in formal legal terms, preferring instead to seek pragmatic ways to expand its role in global affairs.

Indeed, given the circumstances, the two sides have in fact developed a way to allow life to go on without war. With the establishment in 1991 of the mainland’s Association for Relations Across the Taiwan Straits (ARATS) and Taiwan’s Straits Exchange Foundation (SEF) to serve as unofficial embassies to each other, Taiwan moved from its “no contact, no negotiation, no compromise” policy to one of pragmatic management of the relationship. Taiwan participates in international organizations under a variety of names, none of which denotes a sovereign, independent state:

- Under the World Trade Organization (WTO), it participates as the “Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu”; since its WTO accession, it has signed free trade agreements under that name with Singapore and New Zealand.

- The World Bank refers to it as “Taiwan, China,” while the International Monetary Fund and the UN organizations refer to it as “Taiwan, Province of China.”

- In the Asia-Pacific Economic Cooperation (APEC) forum, it participates as Chinese Taipei. In APEC terminology, the participants are “economies,” not “states.”

- In place of embassies and consulates, Taiwan maintains relationships through economic and cultural offices. To underscore the parallels of these offices to embassies (at least in the United States), the United States’ TRA explicitly authorizes the president “to extend to the instrumentality established by the people on Taiwan the same number of offices and complement of personnel as previously operated in the United States by the government recognized as the Republic of China prior to January 1, 1979.”

Taiwan and China both joined APEC in 1991 and the WTO in 2001. The two parties negotiated a trade agreement — the Cross-Strait Economic Cooperation Framework Agreement (ECFA) — in 2010. That agreement opened up direct shipping, flight and postal links. Bilateral trade and investment and movement of persons between the two have increased very substantially and Taiwan’s trade with China is now about three times as large as its trade with the United States.

That said, as shown in Table 1, when we take into account the size of China in relation to the United States, Taiwan’s level of trade with China is less than half as large as one might expect. The distance from Taiwan to China is one-tenth the distance to the United States, and China’s economy has grown from being about 13 percent the size of the US economy to 76 percent of the size over the past two decades. The ratio of relative size to relative distance has thus grown from 1.27 to 7.21. The increase in actual trade with China was sevenfold over the period, but we would have expected a tenfold increase to keep pace with the growth in trade with United States and the relative increase in the size of the Chinese economy. Indeed, taking into account their shared language, the expected level of trade would be even higher than the simple gravity ratio would suggest. It is fair to attribute this under-trading to political risk and Taiwan’s hedging its commercial bets by emphasizing trade diversification.

Table 1: Taiwan’s Estimated Two-Way Trade in Goods and Services with the United States and China, 2002 and 2021 (US$ in billions)

The Military Dimension

Various scenarios have been put forward for a military confrontation, ranging from a blockade to an outright invasion of the main island along the lines of the amphibious assaults that China is practising in Fujian during the current crisis. Intermediate speculation includes China invading some of the smaller Taiwanese islands to precipitate a political crisis in Taipei.

On paper, the PRC army, navy and air force have large advantages over Taiwan’s counterparts in numbers as regards active military personnel, number of aircraft and number of ships (Table 2).

Table 2: Military Power Comparison

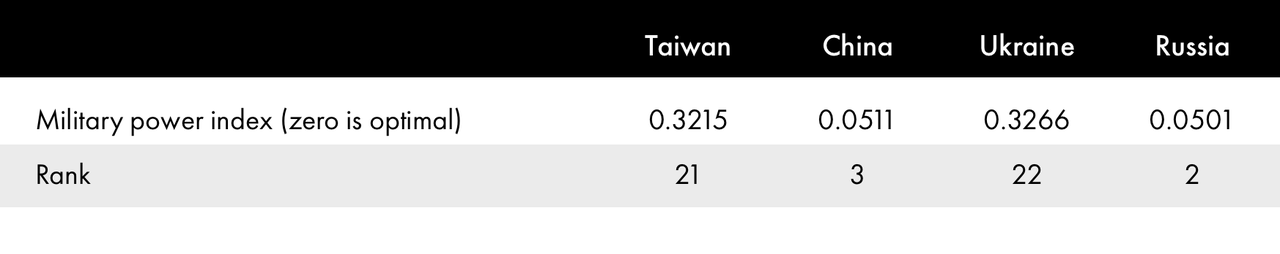

However, to put these figures in perspective, by one evaluation of comparative military power, the gap between Taiwan and China is smaller than the pre-war balance between Ukraine and Russia (Table 3). William J. Burns, the director of the Central Intelligence Agency, has been quoted as saying that the Russian experience in Ukraine has “unsettled” China. Given Ukraine’s resistance to the Russian invasion, that rings true.

Table 3: Military Power Rankings, Taiwan-China Compared to Ukraine-Russia

Indeed, in many ways, the numbers look better for Taiwan than they did for Ukraine.

- Unlike Ukraine vis-à-vis Russia, Taiwan has the natural barrier of 160 kilometres of open water in the Taiwan Strait, which any amphibious invasion force would have to cross, facing naval sea mines and anti-ship missiles.

- Unlike Ukraine on the eve of invasion in early 2022, Taiwan already has relatively modern US-supplied military systems.

- The war in Ukraine has provided valuable lessons to Taiwan and its American backers as to the types of weapons to prioritize. Asymmetric capabilities that are mobile and distributed have proven to be effective in Ukraine, and these are similar to the types of weapons required for the “porcupine strategy” that Taiwan has developed to raise the costs to an invader.

- A war of occupation involves boots on the ground and Taiwan has the largest reserve force in the world. While questions have been raised about the capability of reserves with only four months’ training, the advantage of defending from prepared positions versus attacking raises the costs significantly for the invader — and Taiwan has prepared.

- Whereas China’s top priority in modernizing its military focused on denying a hostile force operational capability inside the first island chain, with the United States in mind, Taiwan has built its military capability specifically to defend against an invasion from China.

One suspects that countries do not conduct serious cost-benefit analyses before going to war — otherwise they would not go to war. A country’s security in the modern context, where technological and economic strength advantages are critical, is served best by enhancing its economy, maintaining access to global technology, preserving the military for national defence and avoiding making implacable enemies. As we may observe, Russia, by going to war against Ukraine, has done the exact opposite: it has damaged its economy, compromised its access to global technology, degraded its military in an offensive operation, and created new and implacable enemies for generations.

Both China and Taiwan have thus had a live cost-benefit analysis conducted for them. In a conflict scenario, China would be rolling the dice — and it could lose big in geopolitical and economic terms, even if it eventually prevailed militarily.

Similarly, for Taiwan, the impression must be that the cost of effective deterrence is much less than the cost of war. This certainly appears to be the lesson drawn by Taiwanese authorities and they are responding accordingly, including by increasing defence spending and focusing on territorial defence capability.

The Economic Dimension

It is common for commentators to observe that China takes the long view because, from its perspective, time is on its side. China’s successful and often spectacular economic transformation has changed the calculus for it on Taiwan enormously — in several distinct ways.

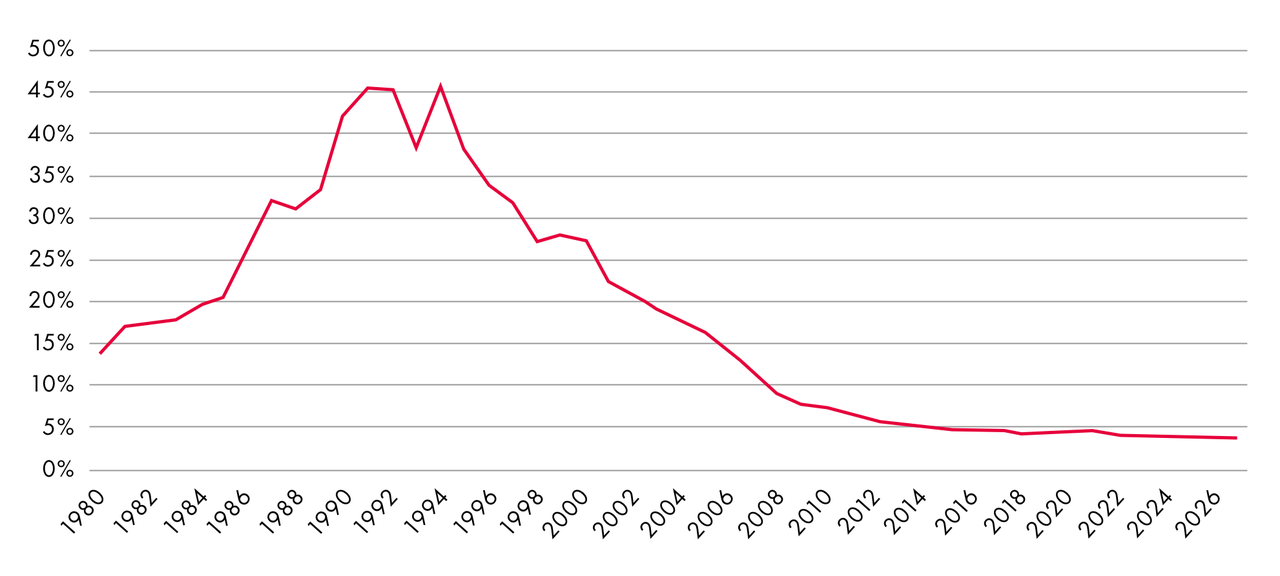

First, China’s economic rise has changed the scale relationship with Taiwan. At the time of the third Taiwan Strait Crisis in the mid-1990s, Taiwan’s economy was 45 percent the size of China’s. In 2021, this ratio had fallen to about five percent (Figure 1). This trend is likely to continue because, contrary to the pessimistic assessment of China’s future growth trajectory based on extrapolation of current demographic trends, China picked a good time to grow old.

In this regard, China has become a leading producer of industrial robots and, because it has a much lower rate of use of these machines than the United States, it has a lot of room for intensification, and hence for labour-saving growth. Further, we are entering the age of scalable machine knowledge capital, which will enable the same kind of steep productivity growth in labour-intensive services industries as was witnessed in manufacturing over the past several decades. China showcased the deployment of service robots in the Beijing Winter Olympics and we are only at the beginning here.

Under a no-war scenario, China will add about two Taiwan economies per year to its GDP over the medium term — painlessly. China does not face a now-or-never decision point on Taiwan (as argued, for example, by Michael Beckley and Hal Brands). In economic terms, time is on China’s side.

Figure 1: Taiwan/China GDP Ratio

The Technology Dimension

The most critical dimension to the China-Taiwan-US puzzle is technology.

China entered the knowledge-based economy around 2010, some 30 years behind the United States. It still trails the United States by a long distance in terms of international receipts for intellectual property and continues to have a massive trade deficit in payments for intellectual property. As trade economists have long emphasized, the point of trade is the imports; exports are how a country pays for the things it wants to buy on the international market. Notwithstanding its impressive progress in developing homegrown technology, China still buys foreign technology in copious quantities, remains vulnerable to technology sanctions from the United States, and remains heavily dependent on technology imports from Taiwan.

As for the United States, while it led the world in developing technology, globalization enabled a value-chain structure that allocated most of the hardware production to Asia. Even for military procurement, an area where the United States has maintained onshore military-specific semiconductor production capacity, its systems also rely on advanced off-the-shelf commercial chips, many of which are produced by Taiwan on behalf of the US defence suppliers that work on the “fabless” business model that involves outsourcing of physical production of the computer chips that they design to specialized foundries. US dependence on Taiwan for advanced computer chips for use in its procured military systems elevates the risk for any action by China on Taiwan.

The United States and China are trying to decouple in this tangled area by de-Sinifying America’s supply chain and de-Americanizing China’s. The US Congress has just passed the US$52 billion CHIPS and Science Act to boost US domestic manufacturing of computer chips. China has committed essentially unlimited public sector support for its homegrown computer chip industry.

However, it’s important to remember how specialized and concentrated this industry is, even at the global level:

- Chip design technology: the EDA, or electronic design automation, sector is dominated by a handful of US firms: Cadence, Synopsys and Mentor Graphics (acquired by Siemens); chip layout design is dominated by the United Kingdom’s ARM;

- Lithographic tools for etching the chips: this sector is dominated by the Netherlands’ ASML, which controls 90 percent of the market and is the only company making leading-edge EUV — extreme ultraviolet — machines;

- Contract fabrication: TSMC accounts for two-thirds of contract manufacturing, is one of only two companies that can produce five-nanometre chips and the only one producing at three nanometres;

- Assembly, packaging and testing: China and Taiwan together account for two-thirds of output.

Moreover, it’s not simply a question of China developing homegrown counterparts to Western firms and the United States developing homegrown counterparts to Chinese or Taiwanese firms; the leading firms cooperate closely in an ecosystem. For example, ASML and Applied Materials Inc., a US firm that provides specialized inputs into computer chip manufacturing, co-locate engineering groups with TSMC’s Taiwan operation. The specialized resources are in short supply and cannot be easily replicated in new locations. Accordingly, both China and the United States are likely years away from removing interdependence. From a conflict avoidance perspective, that is actually good news.

Geopolitics: Are We Losing China — Again?

Following the ascendancy of Deng Xiaoping, China implemented a major shift toward a more market-driven economy and then built, built, built under its motto of a “peaceful rise”:

- Economic infrastructure investments include a network of highways and high-speed rail to integrate its internal economy and, through Belt and Road initiatives, link its economy to its major markets, and a major expansion and upgrade of its airports, seaports and telecommunications systems.

- China’s rate of urbanization rose from under 36 percent in 2000 to over 60 percent in 2021.

- China developed its own satellite global positioning system, its own space station and a space program that landed a Mars rover and returned samples from the Moon.

- China’s universities and innovation system now lead the world in patenting and article citation and put China at the technological frontier at the beginning of the age of artificial intelligence and machine knowledge capital.

- China climbed to lead the world in Fortune 500 companies in 2022 and now claims second place to the United States in the number of unicorns.

That is quite the peace dividend.

Through most of this period, China and the United States have been at least tacit allies. Of particular importance was the renewal of bilateral trade relations following Deng’s visit to Washington in 1979, which led to the United States granting China normal trade relations status and thus allowing Chinese goods to enter the United States under its “most favoured nation” or MFN tariff. Following some bumps in the road (including the chill following the Tiananmen Square massacre of June 4, 1989), President Bill Clinton’s administration extended “permanent normal trade relations” (PNTR) to China in 2000, which paved the way for the incoming George W. Bush administration to broker China’s WTO accession in 2001.

Two-way trade soared as labour-rich but capital-poor China made a natural trading partner for a US economy with the opposite characteristics. And, as the United States launched into its Global War on Terrorism following 9/11, China was supportive, including through intelligence sharing, and was implicitly rewarded by the United States’ supporting its entry into the WTO.

From one perspective, one might say that the United States “won” China back — after having “lost” it when it supported the losing side in the Chinese Civil War of 1945–1949.

The Bush administration term was, as it turns out, the apogee of US-China relations, with Bush leaving office on a constructive note, having brokered a free trade agreement and the reopening of direct links between the mainland and Taiwan in 2008.

However, this was prologue to an abrupt shift toward renewed confrontation. Barack Obama’s administration announced its signature “pivot to Asia” upon assuming office, including not only an economic component with its entry into the Trans-Pacific Partnership negotiations (which were presented in adversarial terms as a contest over who would “write the rules” for trade in the Asia-Pacific), but also a military component with a new Air-Sea Battle Doctrine. China interpreted this as a “containment” policy and countered with its Belt and Road Initiative launched by Xi Jinping.

The rest is history, with the launch of a trade and technology war by the Trump administration, the blame game following the breakout of the coronavirus pandemic, then-US Secretary of State Mike Pompeo’s labelling of China’s crackdown in Xinjiang as a genocide, the escalating war of words as China adopted a “Wolf Warrior” rhetorical stance, all capped by the “no limits” pact between Xi Jinping and Vladimir Putin, which teed up the Russian invasion of Ukraine.

Against this background, it is legitimate to ask whether the fourth Taiwan Strait Crisis is the last nail in the coffin of US-China relations. I would argue no, on several grounds.

First, as the analysis of the various dimensions of the crisis shows, everything points to a continuation of the status quo — a frozen political conflict with continuing deep trade relations across the Taiwan Strait and between the United States and China.

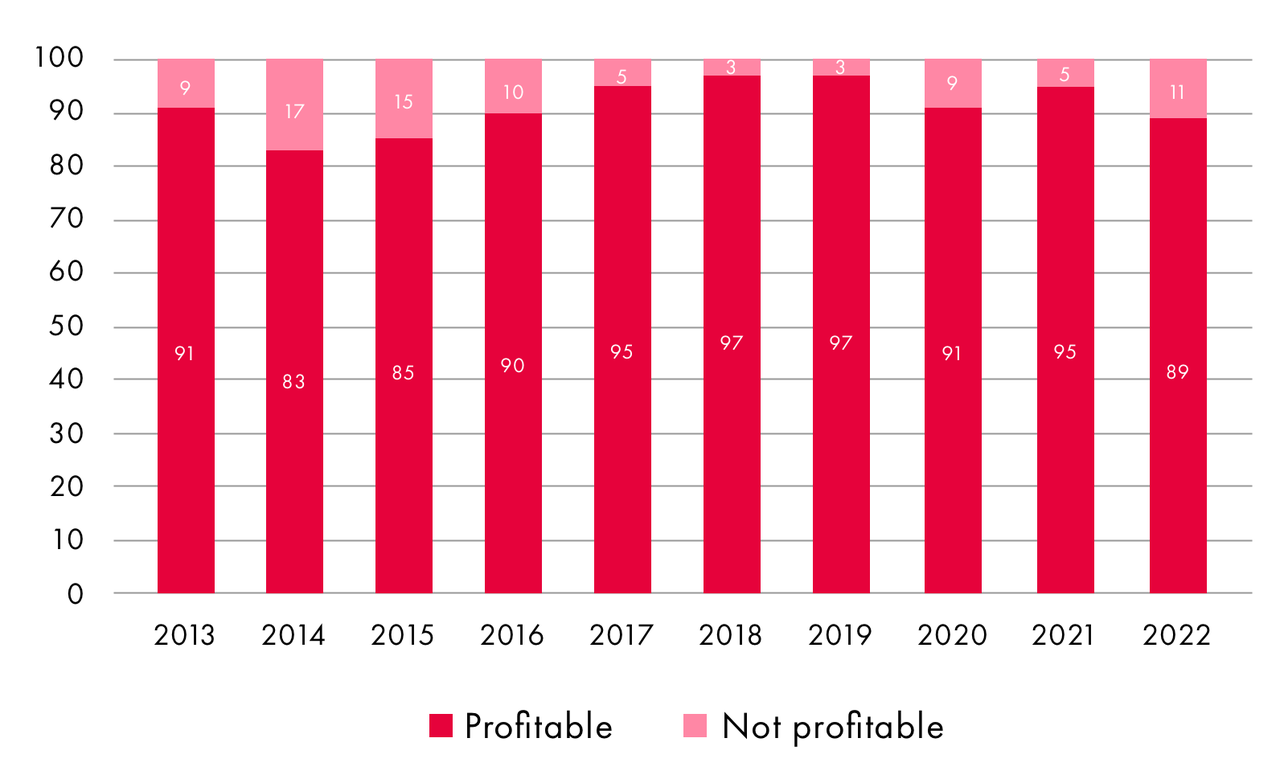

Second, the economic war makes no sense for the United States. The Chinese market is highly profitable for US business (Figure 2). To be sure, the COVID-19 years have proven to be more difficult for US business in China. However, prior to that, profitability rates increased during Xi Jinping’s tenure. For many US businesses, China is more profitable than their domestic market — and their main concern about future profitability is … geopolitics due to Chinese customers’ concern about continued access to US technology.

Figure 2: US Businesses in China by Profitability Status

Third, the technology war will soon be history. US technology sanctions will slow China’s progress to the technology frontier but not prevent it. China trailed the United States by 30 years in entering the knowledge-based economy, but it entered the data-driven era on a competitive footing with the United States and is entering the era of mass deployment of artificial intelligence — the era of machine knowledge capital — on an equal footing with, if not ahead of, the United States. At some point, the logic of a technology war will not make any sense for US policy makers, because, as China steadily closes the technology gap, the dominant impact of continued restrictions will be to imperil US technology sales to China, undermining the private sector research and development capacity needed to sustain US technology leadership. A reset will be required.

Fourth, a generational change in leadership is coming both in the United States and in China. This will occur in a radically reshaped economic and technological context — and one in which the issues that demand cooperation — ranging from climate change to the governance of artificial intelligence — will put a premium on cooperation.

As the current crisis in US-China relations blows over, it would be wise for US and Chinese parties to start a track-two dialogue on a reset. China and the United States are not natural enemies. China is not going away. Neither is the United States. A modus vivendi is required.