Ant Group’s attempted initial public offering (IPO) in 2020 was to be the biggest in world history. If it had succeeded, 18 Chinese individuals would have become billionaires overnight. Unfortunately for Ant, Chinese regulators put the brakes on the deal just two days before it was to go ahead (Yang and Wei 2020). Ant never became the biggest IPO in Chinese history, while Alibaba (Ant’s affiliated company) would, just a few months later, become the recipient of the biggest fine ever issued by Chinese antitrust authorities. The months leading up to that US$2.8 billion1 fine were characterized by a fierce antitrust campaign aimed at China’s tech giants, all of whom have since faced some level of regulatory scrutiny over their business practices.

Western commentators have decried these investigations as boldfaced attempts by the Chinese government to expand its sphere of control (Naughton and Blanchette 2021). The unusual enforcement tactics, severe fines and exceedingly high levels of cooperation typical of these investigations give some credence to these views. But, as sudden, swift and severe as these investigations may have been, they might not have come as much of a surprise for many Chinese tech firms.

For the past two decades, a lax regulatory environment, enormous consumer market and a wealth of cheap labour have given rise to a Chinese tech sector capable of rivalling its US counterpart. Despite its success, the Chinese tech sector suffers from a number of inherent weaknesses often associated with other big tech sectors across the globe. The Chinese digital economy has become highly concentrated, with two companies (Alibaba and Tencent) dominating the market. Although Chinese consumers have enjoyed the myriad conveniences cooked up by these two tech giants, Chinese society has had to bear the costs that come with unbridled growth. Indeed, the highly concentrated Chinese tech sector has sparked concerns over the country’s already wide income gap becoming even wider. When big tech companies grow bigger, so do the wallets of their owners and managers.

With every company vying for a piece of the market, it is no wonder that these firms compete so fiercely with each other. This cutthroat competition for market shares frequently comes at a cost to social welfare. Delivery drivers are continually tempted to drive dangerously to meet tight deadlines set by faceless algorithms while computer programmers around the country are forced to go to work from 9:00 a.m. to 9:00 p.m., six days a week, conforming to a work culture that has been dubbed “996” (Feng 2021). The recent deaths of two employees from Pinduoduo, largely thought to have been connected to the firm’s intense work culture, have put these issues into sharp relief.

These concerns are not uniquely Chinese. The problem of big tech becoming too big is top of the agenda for many Western lawmakers. Just as is the case in China, Western lawmakers have opted to use antitrust law as their weapon of choice to rein in big tech. While the choice of legal tools is the same, the Chinese government’s idiosyncratic approach to antitrust makes it unique.

It was thus only a matter of time before this vast arsenal of regulatory tools would be unleashed upon the unfettered excesses of big tech.

As the author elaborates in her new book, Chinese Antitrust Exceptionalism: How the Rise of China Challenges Global Regulation (Zhang 2021), the structure of China’s antitrust regime allows Beijing to influence big tech in ways that go beyond maintaining a competitive market. The Chinese antitrust law enforcement regime derives its strength from its flexibility, adaptability and impact. Chinese antitrust agencies are seldom subject to challenge, so agencies possess vast discretion in going after companies. Moreover, Chinese antitrust agencies are led by a central ministry that pays close attention to the policy directives of the day, carefully adapting its enforcement efforts to meet these aims. These entities also have a variety of tools at their disposal, from the imposition of hefty fines to ordering a firm to restructure. Besides formal legal tools, they are very skillful in applying media strategies to strategically inflict reputation damage on firms, especially those that are publicly traded.

It was thus only a matter of time before this vast arsenal of regulatory tools would be unleashed upon the unfettered excesses of big tech. Big as these firms may be, their power pales in comparison to that wielded by antitrust authorities. Naturally, Chinese firms often choose to cooperate with regulators. Although Chinese antitrust law is indeed used to address legitimate market competition issues, it can also be used as a convenient tool to launch a host of ancillary policy objectives.

One such objective is industrial policy. Chinese tech companies mostly made their fortunes by providing convenient ways for consumers to connect with merchants, successfully developing China’s e-commerce and mobile payment industries. Despite this unrelenting growth, concerns remain as to whether these companies are really keeping up by producing the most cutting-edge technologies. Consequently, tech companies that have failed to develop foundational science and technologies may be in a tight spot when reliance on foreign supplies becomes untenable. For instance, the possibility for semiconductors to be withheld during the Sino-American trade war came as a rude awakening for companies such as ZTE and Huawei that heavily rely on the supply of semiconductors from the United States.

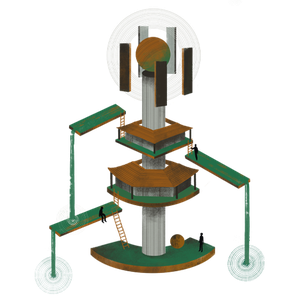

Chinese tech companies have quickly adapted to the government’s call to invest in more hardcore technologies. In fact, the law enforcement campaign that began with Ant Group’s IPO debacle has culminated in a series of large-scale investments aimed at stimulating innovation. Alibaba has pledged $1 billion to nurture 100,000 developers and tech start-ups over the next three years (Yu 2021), and another $28 billion to boost its cloud-computing division to invest in technologies related to operating systems, servers, chips and networks (Kharpal 2020). Notably, Alibaba is also a major contributor to China’s Digital Silk Road, which provides technology to support China’s Belt and Road Initiative. In 2021, Meituan raised a record $10 billion to develop autonomous delivery vehicles and robotics (Bloomberg News 2021).

Over the past decade, China has pursued a wide range of policy objectives, such as maintaining price stability, industrial planning, and achieving trade and foreign policy goals, all under the banner of antitrust. The lack of formal institutional oversight over antitrust law enforcement is ironically its strength. Antitrust law may turn out to facilitate China’s goal to achieve technological self-sufficiency.