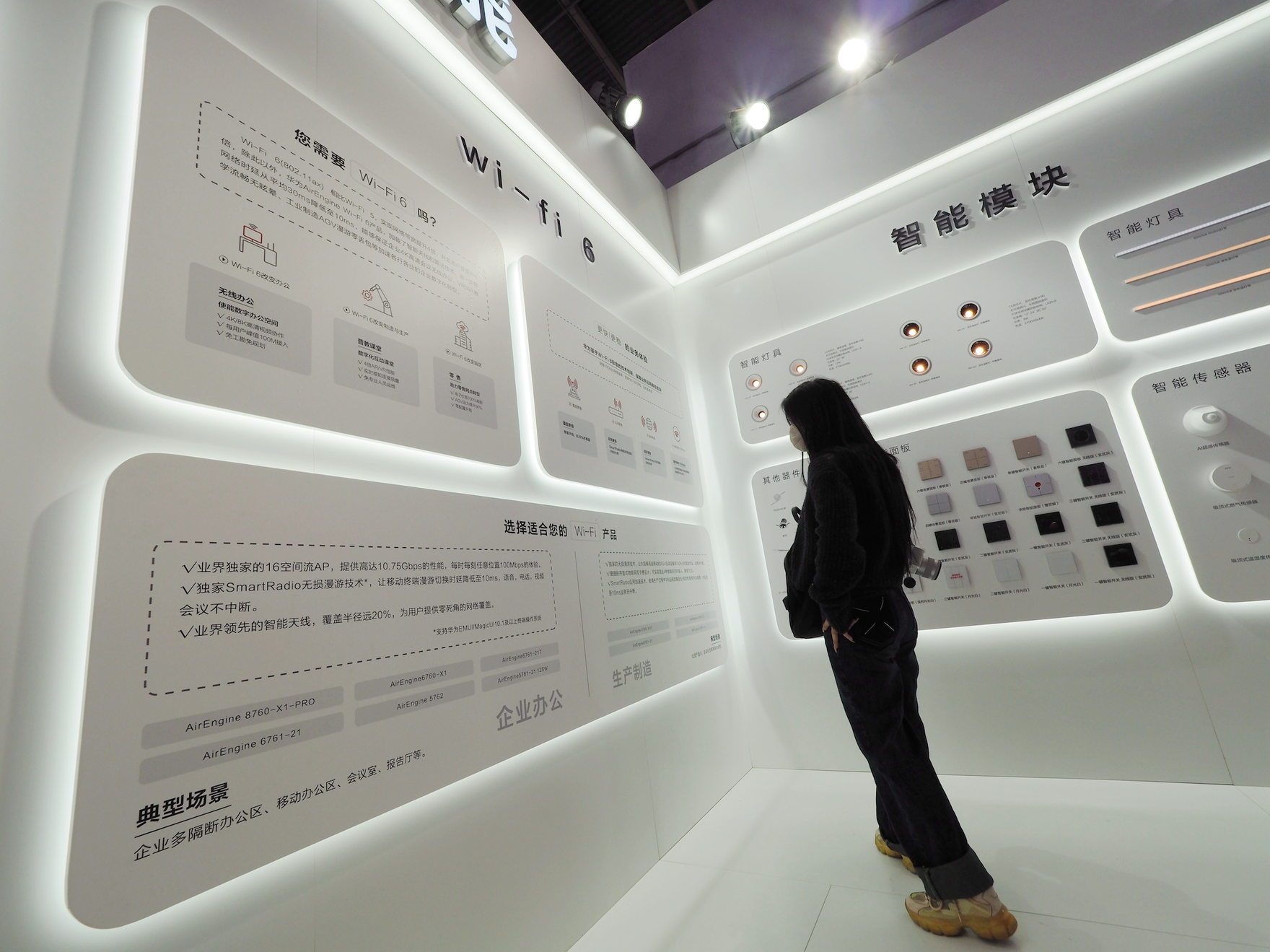

Some prominent Canadian universities, including McGill, the University of Toronto, the University of Waterloo and the University of British Columbia, have drawn criticism for their researchers’ continuing collaborations with Chinese telecom giant Huawei — partnerships that transfer Canadian-funded intellectual property (IP) offshore.

Last week the University of Waterloo responded, announcing it will end its partnerships with the state-owned firm, citing security issues.

But the case of Huawei is not an isolated one. Judging from our recent research, more than half of industry-directed IP that Canadian universities generate is assigned to foreign companies. And not all those companies operate within the ambit of what could be described as friendly democracies.

At the same time, reports that Canada will underperform most advanced economies for the next four decades have stirred fresh interest in our track record on innovation. Canadian policy has far too often enriched foreign companies and citizens at the expense of our own.

Historically, Canadians have benefited from foreign investment in the traditional economy of goods and services. The new economy is increasingly based on intangible assets such as software, data and IP, where the multiplier effect of proximity to physical assets (bricks, mortar, real estate) no longer applies. Freedom to operate is defined as a business’s ability to commercialize its technology while contending with the IP and intangible asset positions of its competitors — you can’t commercialize what you don’t own.

Canadian universities do so many great things — world-class education and cutting-edge fundamental research, to name two. But when it comes to innovation, policy makers have prioritized inputs to research and development (R&D) too exclusively over business innovation. If Canadians are going to extract value from public investments in our universities, we need to prioritize economic development alongside education and fundamental research.

We need to get serious about innovation.

Enough of the superficial celebrations of bright, shiny foreign firms wandering north (or east) to partner with us, usually at public expense. The most recent egregious example of confusing jobs strategy with innovation is the $13 billion package of subsidies Ottawa has promised to Volkswagen to build an electric vehicle battery plant in St. Thomas, Ontario. The value of electric vehicles is in owning intangible assets, not in economic policy borrowed from a 1920s Ford Model T factory.

In a digital economy, even those foreign firms that physically move to Canada and employ our workers leave us in a net negative position when they take the IP we generate. Nine of 15 universities we studied failed on the basis that most of the IP they generate is foreign-owned.

Research-oriented partnerships between Canadian universities and foreign firms are not in themselves bad. Rather, it’s the way they’re being executed that’s wrong.

We have the best and brightest universities and researchers, capable of — and doing —world-class work. When they get a failing grade, it’s much the same as your very smart kid going off to school and coming home with a D or an F. What is the root cause? Is it motivation? Quality of teaching? Lack of feedback? No clear measures? There’s a good chance it’s all of these in some measure. In the end this is a failure of governance.

That’s why governance renewal is so desperately needed. Policy makers providing funding and universities receiving public funding must track and report the flow of their R&D efforts with concrete disclosures, including the size and beneficiaries of economic benefit, stewarding IP to prioritize our citizens and firms. To execute on this, these institutions will need to reorient programs through resource allocation and proper incentives. All Canadian innovation policy (tax credits, economic development programs, foreign direct investment policies) should consider a net benefits test that measures the innovation benefit — measured by increased or decreased freedom to operate for the Canadian economy.

To turn the tide on Canada’s lacklustre economic growth, we need to work differently with foreign partners on freedom to operate and do a much better job of scaling up Canadian companies. Likewise, we must insist on a policy renewal for higher-education R&D. That must include a clear definition of what successful Canadian innovation looks like — and a prescription for how the government, in its role as funder, will hold recipients to account.

This article first appeared in The Globe and Mail.